The cordials category has tremendous diversity and tends to be a catch-all for anything that isn’t a standard base spirit,” says Cherie Koster, senior brand manager for St-Germain liqueur.

Indeed, the fluid, anomalous and wide-ranging character of the cordial and liqueur category is both a strength and a challenge. Among the varied products are liqueurs flavored with fruit, nuts, roots, flowers, spices and veggies; herbal concoctions; cream cordials; flavored whiskeys (which have taken a life of their own); amari; aperitifs and many one-offs.

This diversity means that a variety of consumer trends are driving interest and sales, including a thirst for the new and novel, lower-ABV drinks, flavor fashions and, of course, the cocktail movement. The category is churning with plenty of acquisitions, new products, line extensions and startups coming into the fold.

A Rising Tide

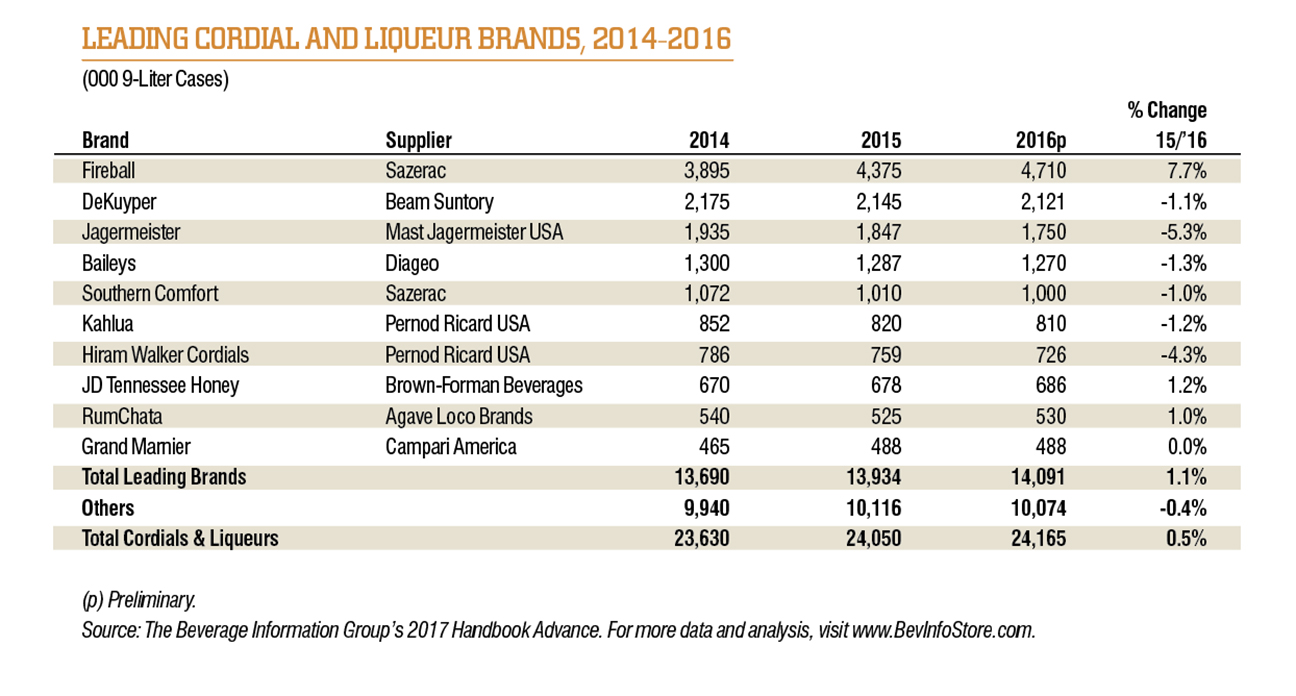

Growth is positive for the category overall. The top 10 leading brands were up 1.1% in 2016, according to The Beverage Information Group’s 2017 Handbook Advance. But performance varied widely. Some brands were on fire—notably, Fireball (up 7.7%), while others showed more modest increases such as Jack Daniel’s Tennessee Honey (1.2%) and RumChata (1.0%).

“RumChata continues to grow both domestically and internationally and already makes up more than 16% of the cream liqueur category in the U.S., ranking it as the second best-selling cream liqueur,” says Tom Maas, founder and master blender of RumChata.

“Our Italian liqueur portfolio is one of the hottest in the industry, consistently growing by double-digits year over year,” says Melanie Batchelor, vice president of marketing for Campari America. Its portfolio includes classic brands Campari, Aperol, Cynar, Averna, Braulio and Frangelico. “Aperol is also seeing unbelievable growth in the US, consistently climbing at more than 30% growth month after month, according to Nielsen figures,” Batchelor says.

Campari also recently acquired Grand Marnier. “This classic liqueur is a high priority both globally and in the U.S., and we’re leveraging Grand Marnier’s broad consumer and bartender appeal to increase exposure to Campari America’s other brands,” she adds.

“We see people shopping the cordial section a lot; that’s a category where people will browse and explore,” says Meru Belbayeva, co-owner and CEO of Downtown Spirits, a Seattle retail store. Big brands like Fireball and Jagermeister sell well, especially among the younger crowd. Other good sellers in the cordial aisle include Kahlua, RumChata, Lillet, Chartreuse and Benedictine, as well as limoncellos and amaros.

“St-Germain sells consistently—it is an item that is hard to replace. Grand Marnier does pretty well for us also, and Pierre Ferrand Dry Curacao competes with that,” Belbayeva adds.

Thirst for the Novel

Many consumers today, especially the questing and curious Millennials, are seeking out new taste experiences—and are discovering a treasure trove in cordials and liqueurs.

“Consumers do not want to drink the same old, same old,” Maas says.

“We are witnessing consumers becoming increasingly more knowledgeable and seeking products with panache and differentiation and are willing to pay more for it, driving premiumization in beverages,” says Morgan Robbat, vice president of marketing for Anchor Distilling Company. The company’s premium liqueur portfolio consists of Luxardo, Tempus Fugit, Briottet, The King’s Ginger and The Genuine Curaçao.

“The modern drinker is more educated these days and they appreciate natural flavors along with some education, provenance and heritage in what they are consuming. Consumers are looking to discover new combinations of flavors,” says Willy Shine, Jagermeister Brand Meister. “We are also noticing a slight exhaustion to overly sweet and salty favor profiles, with a lean towards bitter.”

Many liqueurs and amari hail from Italy, France, Germany and other parts of Europe. Now a number of American craft distillers are getting into the arena. For example, Washington, D.C.-based Don Ciccio & Figli is translating generations of amaro expertise from the Amalfi Coast of Italy to the American market. In 2014, the company launched Amaro delle Sirene. “At that time they were not many amari producers in the U.S.,” says founder Francesco Amodeo. “We were trying to create a new domestic category.” The portfolio now includes 13 spirits.

Bitter is Sweet

“Bitter has got to be the number-one trend in the liqueurs category,” Batchelor says. “All bitter brands are growing right now, driven by both consumer and bartender interest.” Campari America’s Cynar amaro has seen dramatic growth since the launch of Cynar 70 in 2015, and the recently acquired Averna, which has been growing at double digit rates. Its Sicilian Braulio amaro is rested in oak barrels before release.

“The number of amaros on the market has been trending upwards,” Belbayeva says, “and customers always want to try the new ones on our shelves.”

“Italian bitter liqueurs have been growing double digits in the past few years as American consumers are becoming more accustomed to bitter flavors,” says Tanya Cohn, brand manager for Galliano. In response to market demand, the company has just added Galliano L’Aperitivo Italian bitter liqueur to its portfolio in the U.S.

“Over the last few years, consumers have been craving bitter flavors. As a result, we’ve seen an array of bitter spirits, liqueurs and vermouths enter the market,” Robbat says. Anchor Distilling has introduced number of bitter products including Luxardo Amaro Abano, Tempus Fugit’s line of Alessio Vermouths and Gran Classico. Most recently it released Luxardo Bitter Bianco, the first clear bitter in the U.S. market.

New Wave Flavors

“Liqueurs are moving towards refreshing, bitter and dry. Veggie and unusual flavors are becoming more popular – bergamot, yuzu, rhubarb or rocket, just to name a few,” says Giuseppe Gallo, founder of the new company Italicus. Gallo aims to revive the traditional Italian liqueur rosolio by introducing Italicus Rosolio Di Bergamotto, made with Calabrian bergamot.

Don Ciccio & Figli’s latest release is C3 Carciofo, which is a version of the traditional Italian liqueur.

“Tropical, citrus and floral liqueurs tend to be our top performing flavor profiles,” says Kaj Hackinen, vice president and founder of Back Bar Project, producer of Giffard and Bigallet liqueurs. “For a long time, there was a trend of drinking austere, bitter, spirit-forward cocktails. Now, we’re seeing a moving trend toward fun, bright and festive cocktails that utilize flavors like banana, elderflower, peach, pineapple and passionfruit.”

“The popularity of current whiskey flavors has not changed that much and the ‘tried and true’ flavors remain the consumer favorites,” says Becky Henry, senior marketing director for Fireball at Sazerac.

“Fireball is the leader with its cinnamon flavor, but honey and fruit flavors (apple, peach, blackberry) are popular,” she adds. “The added flavors bring new personality to whiskies, which can be enticing to consumers who want to try something different and can also soften the whiskey notes and be appealing to a new whiskey drinker.”

Riding the Cocktail Swell

“Classic liqueurs such as Grand Marnier, Campari and Bols Blue Curaçao are benefiting from a second coming of the cocktail golden age, and consumers being more in tune with what it takes to recreate their favorite cocktail,” says Gilles Bensabeur, senior brand manager for Bols Liqueurs.

Indeed, cordials and liqueurs are often designed as modifiers to base spirits in mixed drinks, and over the past decade, many have risen on the coattails of the cocktail renaissance.

Campari, which was a stagnant brand in the U.S. for decades, surged in the past five years on the strength of the Negroni and the return of classic cocktails, Batchelor says. The brand recently surpassed 100,000 cases in the U.S., after being stuck at around 50,000 cases just a few years ago.

“With the growth of interest in craft cocktails, people see drinks on the menu in bars, and note the ingredients to recreate them at home. That’s a factor driving sales of liqueurs and cordials,” Belbayeva says. The retailer adds that because many recipes call out specific brands, customers come into the store looking for those labels. “If they are making a Midori Sour, they need a bottle of Midori. If looking for St-Germain, they probably won’t be swayed to get St. Elder.” Beginner at-home cocktail makers don’t feel comfortable straying from recipes or substituting.

New Rollouts from the Barrel

There’s plenty of news from producers, who have been busy with new products, line extensions, reformulations and packaging updates.

At one point in its long history, Bensabeur says, Bols produced over 300 different liqueurs. “So over the past few years we have looked to our extensive archive of recipes to bring back some of our old-style liqueurs, such as Bols Parfait Amour and Bols Maraschino liqueur.” Bols also launched a watermelon liqueur.

RumChata has parleyed its liqueur business into a number of different avenues. It recently launched MiniChatas, 25-ml. peel-top creamer cups. This summer, it is introducing a premium ready-to-drink alcoholic iced coffee called FrappaChata. The RumChata Iced Coffee Sampler Pack VAP will also be available this summer off-premise; it includes two 8-oz. ready to drink cans of High Brew coffee with a 750-ml. bottle of RumChata.

Giffard added Wild Elderflower to its portfolio last year. In May 2017, the company launched Giffard Fruit de la Passion, and Caribbean Pineapple liqueur was added to Giffard’s Premium Range.

Repacks Highlight Historic Roots

In 2016, Giffard enhanced the packaging of the Specialty Range of liqueurs, featuring a custom bottle that celebrates 130 years of history with the embossed signature of company founder, Emile Giffard. Designed with the bartender in mind, the bottles feature an ergonomic, elongated neck for easy handling, twist caps for ease of opening and neck labels so bartenders can quickly identify the products in their bars.

Last fall, Jagermeister launched a new bottle with a more defined, taller shape, a more realistic stag and a bold logo type; in addition, the new bottle’s cap bears the signature of Curt Mast, Jagermeister’s founder, as well as the founding year 1878.

Sazerac renovated its Tuaca liqueur brand to take it back to its true Italian heritage. Tuaca is made with Italian brandy infused with Mediterranean citrus and vanilla spice. The new label communicates Tuaca’s original heritage and features a winged lion, a legendary Italian symbol of strength.

Later this year, Campari America plans packaging modifications to Aperol. Recently, the Campari amaro had a label refresh, which now calls out its Milan heritage.

The Bols company also revised labels to celebrate its heritage; the packaging gives a nod to its Amsterdam roots and founding in 1575, all done in a classic Amsterdam-style typography. New back labels suggest signature cocktails with personal tasting notes from master distiller Piet Van Leijenhorst.

For its part, St-Germain is introducing a new size, a 375-ml. format. The SRP is $19.99, allowing consumers to try St-Germain along with their favorite base spirit, Koster says.

Thomas Henry Strenk is a Brooklyn-based freelance writer with over 20 years experience covering the beverage and restaurant industries. In his small apartment-turned-alchemist-den, he homebrews beer kombucha, and concocts his own bitters and infusions.

[…] is the nation’s second best-selling cream liqueur, and it has continued to increase in popularity in recent years. Inspired by the classic Mexican […]

[…] is the nation’s second best-selling cream liqueur, and it has continued to increase in popularity in recent years. Inspired by the classic Mexican […]

[…] is the nation’s second best-selling cream liqueur, and it has continued to increase in popularity in recent years. Inspired by the classic Mexican […]

[…] is the nation’s second best-selling cream liqueur, and it has continued to increase in popularity in recent years. Inspired by the classic Mexican […]