Complementary products — food, glassware, nonalcoholic drinks, etc. — probably do not comprise a large percentage of any retail store layout. No more than 10%, most likely. And their impact on the bottom line may be even less.

Yet these items are still important for the off-premise industry. They generate consistent sales through consumer interest, tapping into trends and impulse buying. Also, they add variety.

“The more we can provide customers with a ‘one-stop-shop’, the better,” says John Shiffer, marketing director for the Virginia Alcoholic Beverage Control Authority, which oversees the state’s 386 liquor stores. “It builds our sales and provides customer convenience.”

So while comparatively fewer consumers come into your store looking for the right corkscrew or cocktail cherries, these products still serve a useful role in your overall SKU mix. Especially when stocked and marketed efficiently.

The Right Mix

Which complementary products a beverage alcohol retail store can and cannot sell depends on the state. (The same can be said for most legal aspects of this industry, of course, as state alcohol laws vary greatly.)

Most states allow a good mix of nonalcoholic items. Savvy stores take advantage, and offer a wide variety of products, most of which tie into the alcohol industry.

“The majority of our complementary items are every-day wine, liquor and bar accessories,” says Laura Farrell, buyer at Haskell’s in Minnesota. “Corkscrews, Vacu Vin stoppers, Wine Away, flasks, shot glasses, shakers, etc. We do carry some gift items that you would find in a traditional gift store: Chirpy Top, Shannon Martin Girl Napkins, Bottle Lights. We also carry food items for cocktails such as cherries, olives, lemons and limes. A few stores even carry craft ice cubes.”

As expected, legal restrictions in Minnesota do limit what Haskell’s can carry on retail shelves.

“Due to Minnesota, law we are unable to sell any grocery items unless they are a part of a drink,” says Farrell.

Offering a mix of products that complement the broader alcohol inventory is an obvious strategy for any retailer. But then again, you never do know what might attract consumer attention.

“Believe it or not, socks have been the most exciting complementary item we have sold this past year,” says David Marberger, owner of Bay Ridge Wine & Spirits in Maryland. “We sold close to 1,000 pair of socks during 2019. Socks?! Other than that, our seasonal gift selection (gravy boats, serving platters, cheese knives, etc.) always sells well.”

While socks may not prove a hot ticket at every business, items that likely belong on your shelves are whatever is locally made.

“Since most of the food items we sell are local products or come from local vendors, we have a great partnership with them and they are excitably agreeable to help us promote their products,” says Marberger.

Premium Products

As the premiumization trend sweeps through beverage alcohol, it’s no surprise that people now also look for higher-end complementary items.

“Our gourmet department has over 400 gourmet cheeses, a large selection of charcuterie, fresh-made sandwiches and salads, gourmet foods that include truffle chips, olive oils and vinegars, crackers, chocolates, jams, snack foods and much more,” says Alexis Wein, corporate gourmet and giftware manager/buyer for Gary’s Wine and Marketplace in New Jersey.

“Out of all the complementary products we sell, the gourmet department brings in the most sales,” Wein adds. “This portion of the business has grown steadily and our cheese selection has increased substantially. Our turns are so high on gourmet cheese that our selection is always fresh and well taken care of.”

Gary’s is far from the only retailer tapping into this trend.

“We have had [more premium] products since April and have had a increase of sales on nonalcoholic every month,” reports Kevin Neitzel, owner of Fridge Wholesale Liquor in Kansas. “We have also found many new suppliers over that time that have helped with our selection.”

Part of the reason for the rise of high-end complementary products is the popularity of craft cocktails. Consumers will experience mixology at an upscale bar and then want to try their own hands at whipping up premium cocktails at home. For that exercise, they require the right tools.

“The retro/classic drink-making items — stir sticks, shakers, big-form ice balls, etc. — are still extremely popular,” says Dustin Mitzel, CEO of Happy Harry’s in North Dakota. “Those tools as a category are on the hottest path right now.”

“Obviously the classic Moscow Mule mug remains popular,” Mitzel adds. “A few years ago, we brought in the Viski brand of cocktail glasses and accessories from True Brands, because they had a retro look. Right now, the more-industrial look seems to be really popular.”

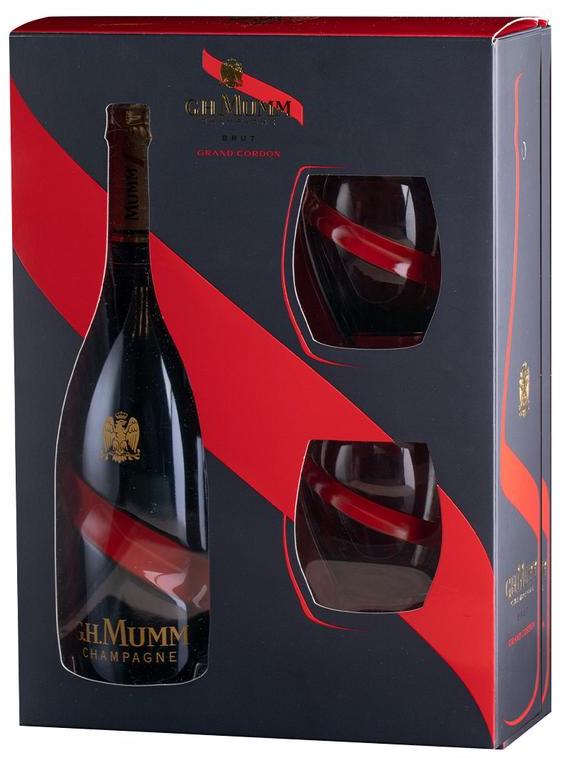

Among the newer premium glassware is The Cloupe, from champagne producer G.H. Mumm (owned by Pernod Ricard). The Cloupe is a hybrid between a flute and coupe glass. It’s narrow enough at the bottom that a standard pour of champagne feels natural, while also large enough (11 oz.) to hold a cocktail. Altogether, The Cloupe is meant to elevate drinking occasions.

“Experience is the name of the game as consumers these days are looking for something interactive and memorable,” says Finian Sedgwick, brand manager for G.H. Mumm. “As more and more consumers make the effort to cook, serve drinks for, and host their friends at home, they want to make the experience engaging. Curated glassware is an integral piece of that, and being able to deliver a story or interesting fact around the glassware as well is definitely an added bonus.”

The premiumization trend also goes hand-in-hand with the healthy lifestyle movement. Consumers today are willing to pay higher prices for products that are more nutritional.

“Recently there have been wants for healthier options, such as gluten-free, non-GMO, organic, a clean ingredient list, etc.” says Wein. “We are seeing this more often, so we are adjusting our portfolio to fit the needs of our guests. Even though some of these healthier options may have a higher ticket price, our consumers are willing to pay more for a ‘clean’ product.”

“Healthier” in alcohol typically means lower-ABV. Hence the rise in reduced- or no-alcoholic products.

“We’re seeing a rise in lower-alcohol drinks, and mocktails, that use high-end products like Seedlip that give the same complexity of flavor to a drink without the alcohol,” says Mitzel. “Healthier is a big trend right now for sure. Things that are fresher, organic: people are gravitating towards that.”

The sustainability trend has also made its way into these products.

“Sustainability remains the number one driver for the industry’s glassware,” says Sedgwick of The Cloupe and G.H. Mumm. “For example, consumers are holding brands accountable with regards to single-use plastics, but as we’re seeing from the likes of Swell and Corksicle, even the bottle or glass needs to go further — whether it is thermal qualities to keep liquid cold/hot, or whether it is able to serve more than one occasion.”

Location, Location, Location

Most retailers set up at least some space — a single aisle or so — specifically for nonalcoholic items. How they further stock these products differs, and can make a big difference in sales.

“Our gift selection is towards the front of our store, close to the checkout lines,” reports Marberger of Bay Ridge Wine & Spirits. “Our mixers, sodas, bar supplies are integrated into our shelf set among our beer/wine/spirit sections.”

Mixing complementary products into thematically similar alcohol SKUs is a common and effective strategy.

“Even though our complementary products do have their own dedicated locations, we do rely on cross merchandising with end caps and other displays throughout the store to market these items,” says Wein of Gary’s Wine and Marketplace. “We keep to an 80/20 rule, which is 80% of the display is a wine or spirit and 20% is a complementary gift or gourmet product. We also market these items by pairing them with wine or spirits during tastings.”

Without the proper display strategies, many of these products would face a tougher time ending up in customers’ carts or baskets. Perhaps more so than any other items in your store, where you place these SKUs really does matter.

“Even though this category only represents around 1.5% of our sales, we have to display it very purposely and properly, because customers buy it when they see it and they think it looks nice,” says Mitzel of Happy Harry’s.

This does not necessarily mean sprinkling all of these items throughout aisles that contain alcohol. These products can help maximize your overall layout.

“We also look for areas that, spatially, don’t work out for a whiskey or beer display,” Mitzel adds. “We find areas of the store that we can’t merchandise with traditional beer or spirits, and fill those with this category. Items like beer cozies or cork cages, which help get people thinking of the things that really do create add-on sales.”

Marketing Matters

The best marketing behind complementary items is not too different from how you already advertise for alcohol SKUs.

“Complementary products do go on promotion, coupons are offered and they are included in our ‘Thank You Sale’, which is our biggest sale, held twice a year,” says Wein of Gary’s Wine and Marketplace. “Another way we market these items is through active and passive demos of gourmet food and cheese items.”

There’s also the tried-and-true strategy of traditional, local marketing.

“For the more unique gift items, we might promote them during a sale, or a feature on Ted’s Twin Cities Live Segment or [her husband and store co-owner] Jack’s weekly radio show,” says Farrell of Haskell’s. “Last December we featured the Chirpy Top wine pourer on both the TCL and radio show, back to back, and saw Dec 2018 sales quantities happen in three days. I attribute the sales to the uniqueness of the items and TV/radio.”

As many of these products are small and upscale, they make for ideal gifts. Come holiday season, this is another boost for the bottom line.

“During November and December, we had to increase our shipments on nonalcoholic products to biweekly to keep up with demand,” says Neitzel of Fridge Wholesale Liquor. “Our sales during the holidays were fantastic, and gave us great feedback on products that will continue to work in the store.”

In a sign of the times, effective marketing for these products can also come from outside of your store.

“I’ve noticed that many of these companies have recently begun advertising more intensely,” says Mitzel of Happy Harry’s. “Coravin, for example. People saw ads for it on television and then came in and asked for it, so we reached out and became a Coravin carrier. I had never seen something like that happen before in complementary products.”

Like with alcohol brands, companies behind these items are more eager than ever to work with retailers on promotions.

“Above and beyond supporting innovations with good shelf or floor displays with a strong call to action, retailers can look at working with the relevant brands to share recipes or suggested drinking rituals, where relevant, to encourage at home consumption and new experiences (e.g. Champagne cocktails),” says Sedgwick of The Cloupe and G.H. Mumm. “This can also help increase the overall cart size and spend, as consumers add the relevant items to build their cocktails.”

“At G.H.Mumm, we’ve put together some exciting and easy-to-make-at-home recipes that we work with some retailers to share but we also include a push to social [Instagram: @ghmumm_us] for consumers to discover additional recipes and learn more about the brand,” Sedgwick adds.

This category has certainly changed a lot in recent time. Premiumization is a primary driver, with consumers looking to purchase higher-end products to match their craft alcohol consumption. With the right selection, marketing and location strategies, complementary products can remain a small but important part of your yearly revenue.

Kyle Swartz is editor of Beverage Dynamics magazine. Reach him at kswartz@epgmediallc.com or on Twitter @kswartzz. Read his recent piece How Liquor Stores Adapted to the COVID-19 Crisis.