The spread of COVID-19, as with elsewhere, has had a huge impact on the beer category. This was perhaps most true for craft. Emerging trends like the taproom boom, with the possibility that many microbreweries could survive as on-premise local businesses, have come into question.

Early in the pandemic, things looked grim. Numbers thrown around (perhaps a bit rashly) predicted that 40-50% of American craft breweries might close down. Unable to open for on-premise sales, many of these taproom-focused businesses appeared doomed.

Months later into the pandemic now, has that dire prediction proven true? The ability of breweries to adapt might just mean a survival rate higher than originally anticipated.

What about macro beer, imports and hard seltzer? How have these fared in this year of the coronavirus? For the most part, the crisis has boosted sales of these products. We’ll explain why.

Covid-19 Upsets the Beer Landscape

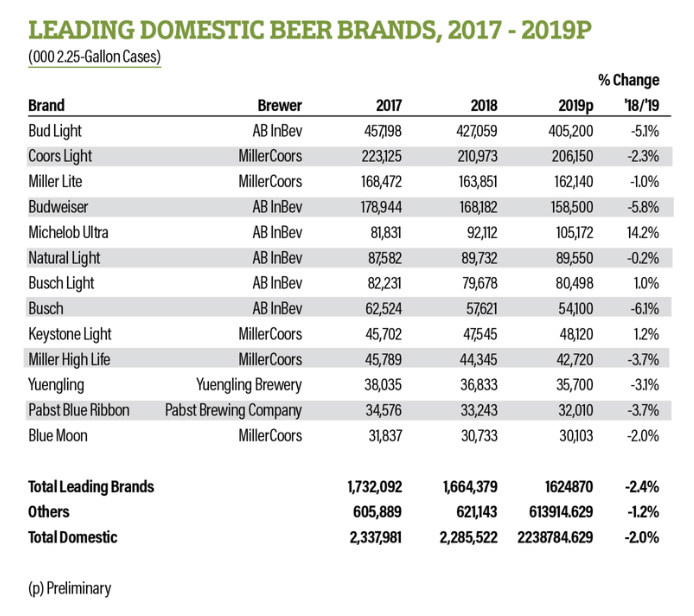

Initial trends in the pandemic favored macro. Customers stocked up on large-format packages of name brands, rather than browsing stores for smaller or new releases. Even as America settled into its new world in the months that followed, and consumer experimentation somewhat returned, the advantage now seemingly remains with larger brands.

“I wouldn’t say the pandemic has been good for anyone, but those more well-known, nationally distributed brands are definitely not being impacted as much as those smaller, local craft breweries,” says Dogfish Head Brewery Founder Sam Calagione.

During those early days of uncertainty, “people came into our store in mask and gloves and they wanted to grab the stuff that they knew,” recalls Jason Daniels, COO of the leading NY-based beer retailer Half Time. “They would put it in their cart and then get out of the store as fast as possible.”

Now, “people have gotten more used to how things are,” Daniels says. “They’re spending more time in the store.”

Although experimentation may not be as high as it was pre-Covid, Daniels does see more people browsing through craft options. But there is no denying that the pandemic has boosted sales for bigger brands of all types.

“Sierra Nevada, Allagash, Ballast Point and New Belgium have all been moving quite a bit,” Daniels says. “The recognizable names among craft brands are doing well, like Toppling Goliath and Montauk Brewing.”

Although the stock-up mania of March may be over, consumers in this environment may still prefer what’s better known.

“Covid has forced us all to look more on the value and quality side,” says Founders Brewing Co-Founder Mike Stevens. “For the year or year and a half that Covid is with us, and the economy remains bruised, people are going to lean towards trusted brands.”

This actually fits with a recent trend among larger-scale craft breweries.

“I’ve been preaching for years the need to focus on core brands,” says Stevens. Founders is known for national best-sellers like All Day IPA, Solid Gold and Centennial IPA. “The business model to put out new products every couple of months, eventually that efficiency deteriorates.”

One setback for major brands is that this crisis has disrupted production and distribution channels. Consistently stocking popular products has been a struggle for retailers nationwide.

This includes top-selling Mexican brews like Corona and Modelo, both owned by Constellation Brands.

“The temporary slowdown of our beer production in Mexico impacted shipments in Q1, extending into Q2,” says John Alvarado, SVP Brand Marketing, Constellation Brands, beer division. “The combination of this production slowdown and continued strong consumer demand for our brands has resulted in some cases of tight supply at retail.”

“We have since returned to normal production levels in Mexico and continue to prioritize production of our-top selling SKUs (which represent about 75% of our total volume) to help ensure consumers by and large can find our brands at retail,” Alvarado adds. “Supply will continue to be tight on select slower-moving SKUs, as demand for our brands remains strong in the off-premise, and we expect to return to normal inventory levels in Q3.”

These issues have affected many name brands.

“We’ve seen shortages in Heineken, Budweiser, Bud Light, Corona, White Claw and also Coors at one point,” says Daniels. “We’ve put out calls to every supplier we know in trying to track down some these brands.”

The pandemic, coupled with hard seltzer’s explosion, has also led to shortages in cans and glass bottles.

“Can manufacturers are operating at capacity right now, so there is no quick solve for this,” says Brandon Cason, founder of Canteen Vodka Soda. “The Brewers Association is suggesting the supply won’t meet demand until the end of 2021, so craft brewers and smaller brands will be forced to pause production or create alternative packaging.”

“Can distributors are more likely to provide the supply they do have to larger beverage companies, like Coca Cola, so smaller startup brands and craft breweries will have access to less, meaning their production will be limited,” he adds.

The spike in sales for ready-to-drink canned cocktails has also eaten into the aluminum supply.

“Consumers want drinks that are easily portable and affordable, which is where we’ve seen a huge rise in RTD cocktail sales,” Brandon says. “The Wall Street Journal recently reported that sales of aluminum drink cans in the U.S. increased by 24% by volume in March alone.”

Hard Seltzer Grows, Evolves

Hard seltzer remains red hot in 2020. These products accounted for 25% of all beer sales on Drizly during the month of July, according to the company’s consumer insights team.

Category leader White Claw, by its own estimation, is up a staggering 275% in sales this year. “White Claw has the second highest household penetration in all of beer,” a company spokesperson says, “higher than large megabrands Coors Light, Budweiser and Corona.”

By all appearances, this category has plenty of runway left for growth. Hard seltzer benefits by reflecting multiple consumer trends. These drinks are typically “healthier” and lower-ABV than beer (trend: wellness), contain all-natural ingredients (trend: premiumization), vary in flavor (trend: experimentation), come in cans (trend: to-go) and appeal to nearly every demo (trend: accessibility).

So the question is: How big can this category grow?

“We believe that hard seltzer can follow a similar growth trajectory as light beer, because it offers a unique and attractive proposition to consumers due to its varied flavor profiles, high-quality ingredients and refreshment,” says Lana Kouznetsov, VP of beyond beer at Anheuser-Busch. “We know that hard seltzer drinkers do not want to sacrifice the tastes they love, and are looking for more complex offerings that still provide the refreshment of a hard seltzer.”

This consumer need for “complex offerings” has fueled the next evolution of hard seltzer. Anheuser-Busch recently released Social Club Seltzer: a blend of hard seltzer and the also-trendy RTD movement. It’s also a bit higher in ABV.

“With classic cocktail flavors, including Old Fashioned, Sidecar and Citrus Gimlet, it’s a hard seltzer for the occasions when consumers want something different, and is inspired by classic cocktails consumers would enjoy at a premium bar,” Kouznetsov explains. “When we created Social Club Seltzer, it was with the thought of deviating from something expected in the category, and delivering the flavor and product that we knew our target wanted.”

Bud Light Seltzer launched early in 2020. Already it has captured an 11% share of the hard seltzer category, the company says. The brand continues to evolve with new flavors: Cranberry, Grapefruit and Pineapple.

And like Social Club, Bud Light Seltzer will also offer drinkers a high-ABV option. This fall, Bud Light Platinum Seltzer hits shelves nationwide with 8% ABV. This new product comes in three flavors: Citrus, Wild Berry and Blood Orange.

Most global beer companies joined the seltzer party in 2020. Constellation Brands unveiled Corona Hard Seltzer in March. “Seltzer is a huge trend that has impacted the beer industry in the past year, and we don’t see that stopping anytime soon,” says Ann Legan, VP brand marketing Corona.

Craft brewers of all sizes have also canned their takes on hard seltzer. These tend to place even greater emphasis on flavor and all-natural ingredients.

“Our goal was to make a hard seltzer that actually tastes good,” says Stevens of Founders. “We wanted a more natural approach, utilizing agave and fresh fruits.”

Founders Más Agave Premium Hard Seltzer launched over the summer.

“We knew that if we were to release a seltzer, it would have to appeal to craft drinkers and seltzer drinkers alike,” Stevens says, “meaning the flavor and the quality had to be top-notch, while also delivering on the health credentials.”

21st Amendment Brewery, founded in 2000 in San Francisco, rolled out their SOMA Hard Seltzer over the summer.

“SOMA Hard Seltzer is brewed with our craft roots in mind,” says Co-Founder and Brewmaster Shaun O’Sullivan. “Unlike other hard seltzers, 21st Amendment’s is made using a natural fermentation process, giving it a cleaner flavor. SOMA Hard Seltzer is not made with grain neutral spirits, and then diluted with water. Many hard seltzers made that way have a metallic, artificial taste.”

Although hard seltzer is definitely eating into the shelf space of craft beer, 21st Amendment Co-founder Nico Freccia sees a harmony between the two categories.

“Hard seltzer is about maintaining your alcohol intake,” he says. “People can sip on hard seltzer all day for a light buzz, and it’s not filling. In the evening, they can switch to craft beer or wine.”

How Does Craft Beer Survive?

Given the taproom boom, Covid-19’s timing could not have been worse for craft beer. Still, despite this massive setback, few people still predict nowadays that half the microbreweries in America will shutter.

“I certainly think there’s going to be plenty of them that survive,” says Stevens. “There’s always going to be a place for local craft, without a doubt. We need that. It makes us feel good, healthy and bright.”

“With the amount of breweries that we had before Covid, we were certainly bursting at the seams,” he adds. “Those that were over-leveraged or managed poorly won’t survive, which is unfortunate. But at the end of the day, if 10% to 20% of breweries don’t make it, that’s the tough result that Covid has brought upon us.”

Freccia of 21st Amendment believes that this could be healthy for craft in the bigger picture.

“The craft industry was in a golden age for so long. From 2010 to 2016, the industry could do no wrong,” he says. “That fueled the mad dash for so many people to open up breweries. Consumers became overwhelmed with variety, with too much competition on the retail shelf.”

Now, a paring back — and a focus on established brands — may both be beneficial.

“It’s good for craft beer, because that constant dash to innovate was unsustainable,” Freccia says. “A lot of retailers were bringing in local for the sake of local. But that doesn’t mean those beers were good. People were buying bad beer, which turned them off of the entire category. The 2010s also saw the decline of brand loyalty. Now that’s starting to come back. People are grabbing more Sierra Nevada, Lagunitas and 21st Amendment.”

“Covid accelerated a lot of trends that would have taken a few years to play out in this category,” he adds. “Distributors and retailers don’t want to bring in as much new stuff anymore.”

As long as the virus stymies on-premise sales, the key to survival for craft breweries is retail.

“If you were putting [your craft beer] into packaging and getting it into retail stores, then you entered the pandemic two months ahead of everyone else, and were able to minimize your losses,” says Daniels of Half Time.

One day in the not-so-distant future, America will reach the other side of this pandemic. When that happy occasion arrives, what will the craft industry look like?

“It’s hard to tell exactly what the future will hold, but I will say this: craft brewers are resilient and determined individuals that are continually adapting to the changing industry and marketplace,” says Calagione of Dogfish Head. “If anyone can recover from the economic shutdown, it’s craft brewers.”

Low-ABV Beers Remain Hot

Another trend holding strong is lower-ABV, “healthier” beers.

“The biggest trend we are seeing right now is the increase in popularity of ‘better-for-you’ offerings,” says Calagione. “In the last five years, we have seen more and more craft beer lovers — especially those Millennial drinkers — searching for lighter, more sessionable products that seamlessly fit into their active lifestyles.”

Last year, Dogfish Head released Slightly Mighty, with 95 calories, 4% ABV and 3.6g of carbs. The product has captured 25% of the low-cal craft beer market, according to Calagione. “As more and more folks are realizing the importance of leading a balanced life, lighter, ‘better-for-you’ beer options are increasing in popularity,” he says.

Consequently, more macro brands have also released healthier alternatives. Constellation Brands recently came out with Corona Premier.

“With 2.6 grams of carbs and 90 calories, Premier provides an ultra-light, sessionable profile and guilt-free drinking experience that appeals to consumers that believe in a holistic approach to wellness,” says Legan. “The Corona Premier consumer enjoys our beverage on the golf course, and during their leisure hours when they are on their own time and pace.”

Mexican Brews Unite Us

Mexican beers (when in stock) remain a top seller in 2020. A large part of this achievement is the category’s ability, in recent years, to cross demos. Rather than focus only on multicultural markets, Mexican brews have successfully attracted U.S. consumers of all backgrounds.

As you might imagine, cross-demo appeal remains a top goal for these brands in marketing and promotions.

“Modelo’s Fighting Chance Project Concert series with Anderson .Paak helped the brand resonate with a more general market consumer, and met consumer’s expectations for what they were looking for in a brand — a strong voice to do good,” says Greg Gallagher, VP brand marketing Modelo. “Modelo’s Fighting Spirit campaign continued to resonate strongly with consumers and showcased that Modelo is an inclusive brand.”

Not that these brands have lost track of where they come from, of course. Modelo also celebrated its Hispanic heritage in 2020 with programming around Cinco de Mayo and Día de los Muertos, Gallagher says. The brand also reached its core Hispanic consumer group with marketing for the Gold Cup.

But these brands have not achieved widespread success without reflecting broader American trends.

“For Corona Premier, our multi-year partnership with the U.S. Open of Golf and our focus on wellness-specific initiatives propelled the brand forward in 2019,” says Legan of Corona. “We also developed a fully integrated platform with year-round support focused on healthy grilling and fitness. We found our consumers were looking to enjoy their favorite products while still keeping an eye on the health benefits, so Corona Premier leaned in and found success because we met our consumers where they were.”

Beer Beyond 2020

America and the rest of the world will overcome Covid-19. So will macro brands and most large-scale craft producers. When will that happy day arrive? And what about the rest of the industry?

“This is not an open-ended problem: the finish line is the vaccine,” says Stevens of Founders. “We’re going to be dealing with this at least through the mid-to-end of 2021. Face it that way and design your business thereafter.”

“I think the small brewers, if they can hang on to that day, they’re going to be fine,” he adds. “They’ll be little rocket ships when this is done, because everybody is going to want to go out and celebrate.”

Feature photo by Timothy Dykes on Unsplash.

Kyle Swartz is editor of Beverage Dynamics magazine. Reach him at kswartz@epgmediallc.com or on Twitter @kswartzz. Read his recent piece What’s Behind the Beer Can Shortage?

[…] genellikle vegan ve glütensiz, orijinal karışımlar, doğal içerikler ve kullanışlı – zor seçiciler ‘daha sağlıklı’ ve suçsuz bir içme deneyimi arayanlar için çekici bir seçimdir. […]