Want to know what’s next for the beer category? Walk the exhibitors halls at the National Beer Wholesalers Association’s (NBWA) 84th Annual Convention and Trade Show, and you can glimpse into the future.

Held earlier this month in Las Vegas, the yearly show invites hundreds of suppliers to sample their latest beverage innovations. Beer distributors and media alike tasted through these diverse products. Doing so, trends emerged about what the years ahead will hold for the beer category.

These 12 newer products at NBWA 2021 reflect those beverage alcohol trends:

Kalo Hemp Infused Selzter

One of the larger trends at the 2021 conference was the preponderance of CBD drinks. Dozens filled the ranks of exhibitors, including Kalo.

Available in 13 states, this nonalcoholic beverage contains only 2 grams of sugar and 15 calories. It’s not overly carbonated, drinking smooth by design. Kalo is intended as a recovery drink, with vitamin C and D in the recipe. Here we see the future of CBD beverages: canned, easy-drinking, flavorful, low-cal and focused on functionality over flashy branding.

BeatBox Beverages Zero Sugar

This Growth Brands Award-winning brand was onsite pouring their new zero-sugar boxed wine punch. After successfully tapping into the booming RTD trend, it appears that BeatBox has now also stepped into the “healthier for you” drinking movement.

How come? Speaking to the owners, they point out how they originally launched the brand in their 20s. (Recall their youthful-but-profitable appearance on “Shark Tank.”) Now in their 30s, the founding trio has joined the wave of Millennials and other consumers reaching for zero-sugar Gatorade and other “healthier” products. That is, full flavor, but less or no sugar.

BeatBox also recently launched new variety packs for their 6% and 11% ABV options.

Cüre Chill CBD Shots

Functionality remains at the core of the emerging CBD beverage industry. This brand of single-serving shots and gummies names its products based on their intended use: Focus, Chill, Sleep.

Cüre is currently available in 10 states.

Mighty Swell

Beyond CBD, the other major trend at NBWA 2021 was the number and variety of hard seltzer brands. Despite an explosive start in recent time, this category still remains young, with many consumers still not decided on their favorite brands. Accordingly, companies large and small are jockeying for position, searching for their profitable niche.

One of those niches is flavors. Brands like Mighty Swell seek consumer attention with their new lineup of bold, eye-catching flavors: Tiger’s Blood, Pink Colada, Rocket Pop, and Purple Magic. Appropriately, these all come in a new mix pack with the tagline, “Keep It Weird.”

Mighty Swell is in 28 states.

Western Son RTDs

Another Growth Brands Awards winner, this Texas-based craft distiller recently released their lemonade vodka bottled RTD. Why a plastic bottle? Because everything else is already in cans, their reps say, zigging where so many other brands have already zagged.

Western Son, available in 48 states, will also launch a line of 1.75-L ready-to-serve cocktails in Q1 of 2022.

Sonic Hard Seltzer

Perhaps the most eye-catching of all brands at NBWA 2021 was this hard seltzer with the name and likeness of a certain fast food chain. Launched in May in partnership with Coop Ale Works, Sonic Hard Seltzer is in Oklahoma now, with Texas, Missouri, Arkansas and Nebraska planned by the end of the year.

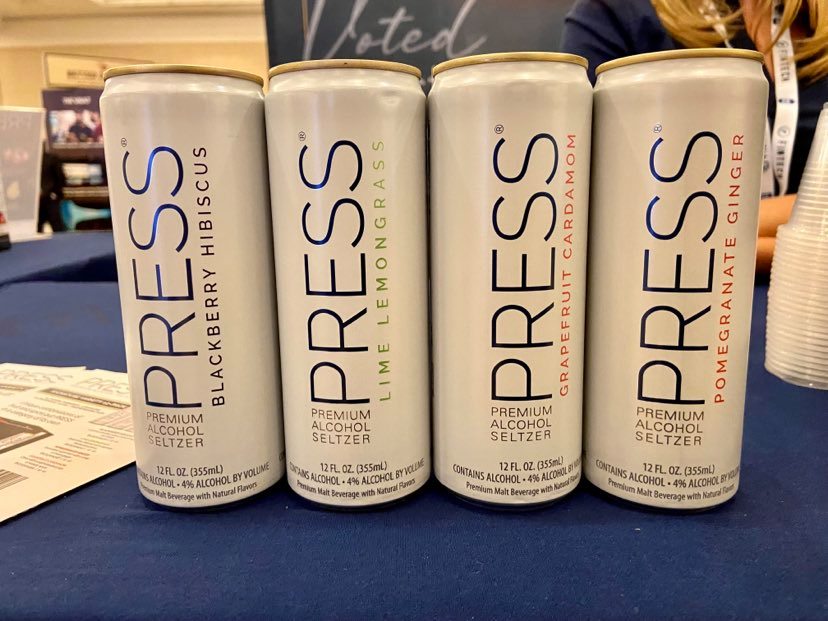

Press Premium Hard Seltzer

The name says it all. As the hard seltzer category continues to take form, and brands seek niches, Press aims for the premiumization position. Packaging and flavor profiles — Lingonberry Elderflower, Pineapple Basil, Blackberry Hibiscus — all imply an upscale product.

Press distributes in the lower 48 states.

White Claw Surge

What has the category leader been up to? The latest innovation from White Claw is Surge. Notably this has a higher-ABV, 8%, than standard White Claw. Representatives say this is because they found many people on-premise were ordering a White Claw with a shot of vodka and then mixing. Here, consumers can simply drink a boozier version.

This is another trend — higher ABV — currently rolling through hard seltzer and RTDs.

Bells Rind Over Matter

With all this hard seltzer, CBD and category innovation, don’t forget about the legacy brands still putting out great products. First opened in 1985, this original craft brewer, known for their ubiquitous Two Hearted Ale, continues to impress. Rind Over Matter is a fall-seasonal release, a wheat ale made with orange and lemon zest.

Partake Brewing Non-Alc Beers

As previously covered, Partake likely represents the future of nonalcoholic beer. This Canadian craft brewer produces an impressively diverse variety of beer styles, all of which taste on-recipe, despite the lack of ABV. Their latest release is a peach gose, an unthinkable nonalcoholic option just three to five years ago. But the Partake gose tastes like the real deal, showing how these brands no longer sacrifice flavor with ABV.

Partake is in 22 states.

Island District RTDs

This RTD brand shows how the premiumization trend is also strong in this category. The branding and flavor lineup both imply top shelf. Options include Coconut Water Cranberry Mango, Green Tea Passionfruit Dragon Fruit, and Coconut Water Blueberry Pomegranate.

Launched this year, Island District is made with all-natural ingredients and no added sugars. These spirits-based RTDs (which list either vodka or tequila on their labels) also tap into the better-for-you drinking trend. They’re only 5% ABV, and contain natural electrolytes.

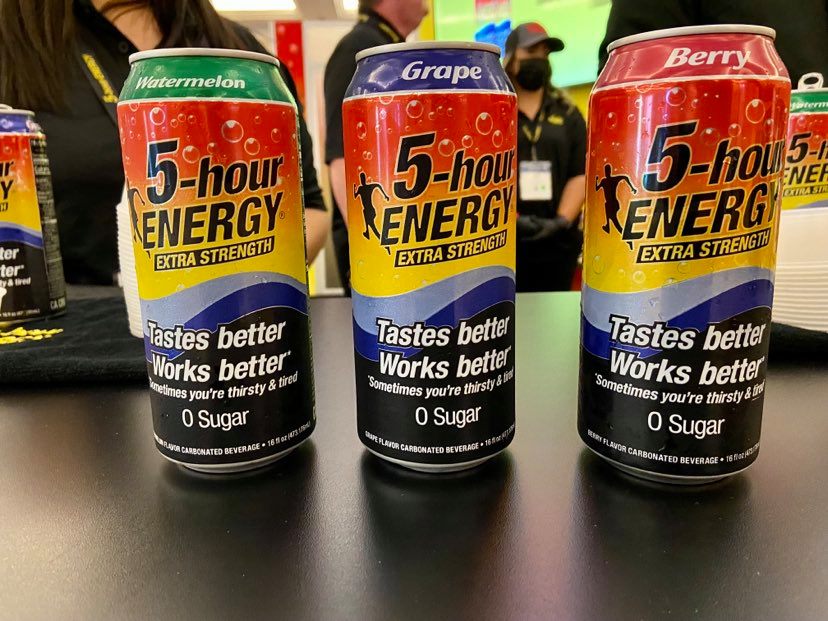

5-Hour Energy 16-oz. Cans

Plenty of energy drinks poured samples at NBWA 2021. Category-leader 5-Hour Energy had their latest offering, a 16-oz. canned beverage that contains the same amount of caffeine as one of their shots. These carbonated-water beverages come in Watermelon, Grape and Berry. For a suggested retail price of $3.75 per can, they’re available in limited test markets for now.

Kyle Swartz is editor of Beverage Dynamics magazine. Reach him at kswartz@epgmediallc.com or on Twitter @kswartzz. Read his recent pieces, Interview: Anheuser-Busch CMO Marcel Marcondes and The 2021 Beer Growth Brands Awards: The Top Brews.