The 2018 Beverage Dynamics Beer Growth Brands look back at what brews sold best in 2017, a year when the category again slipped slightly.

Certain parts of the industry lagged. Macro brands continued to recede. Modern consumers, ever adventurous, experimented across microbrews and other beverage categories. Craft beer also hit more headwinds. This was due to oversaturation, as new brands and brews flooded the market, plus increased competition from wine and spirits. Although still growing, the craft craze has undoubtedly slowed.

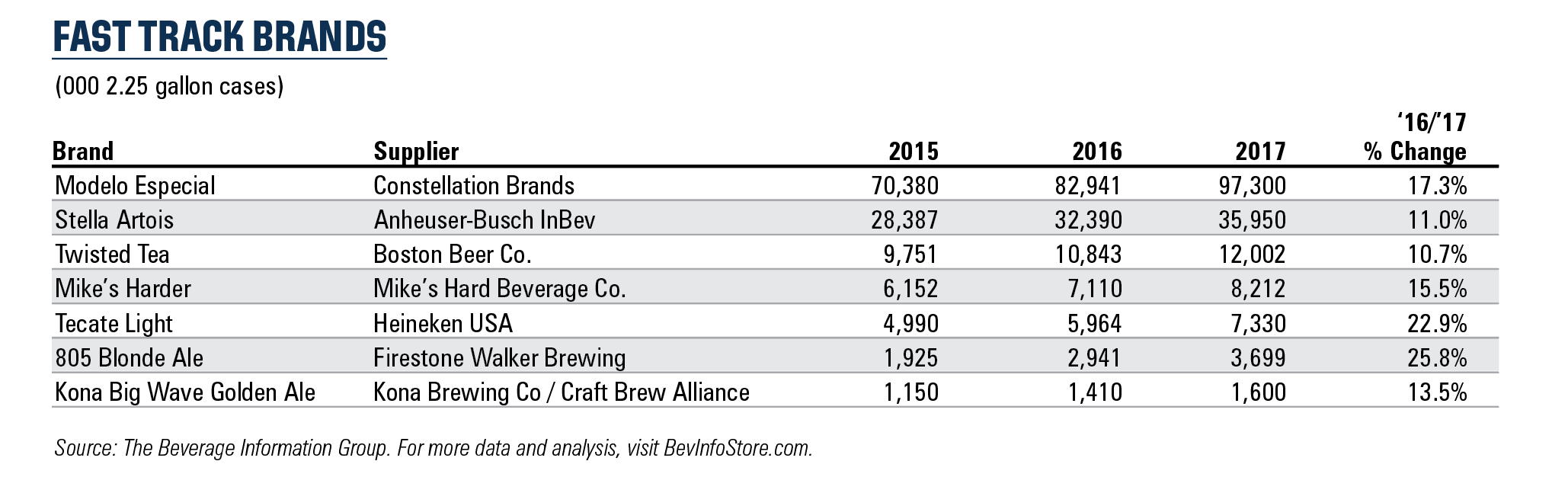

Where beer gained the most traction last year was with imports and flavored malt beverages (FMB). Mexicans brews continued to succeed, while Stella Artois, the Belgium lager, enjoyed another strong showing.

“We know that now more than ever Millennials are enjoying beer not just at a bar, but at home with friends so we want to make sure we’re speaking to that trend,” says Harry Lewis, VP Stella Artois. “From a brand perspective, we believe that Stella Artois is best enjoyed over delicious bites with good friends, which is why we focus on promoting usage occasions that encompass happy hour and beyond.”

Meanwhile, consumers still cannot get enough of hard sparkling seltzers and waters. These refreshing, low-ABV options saw a number of brands skyrocket up the sales chart.

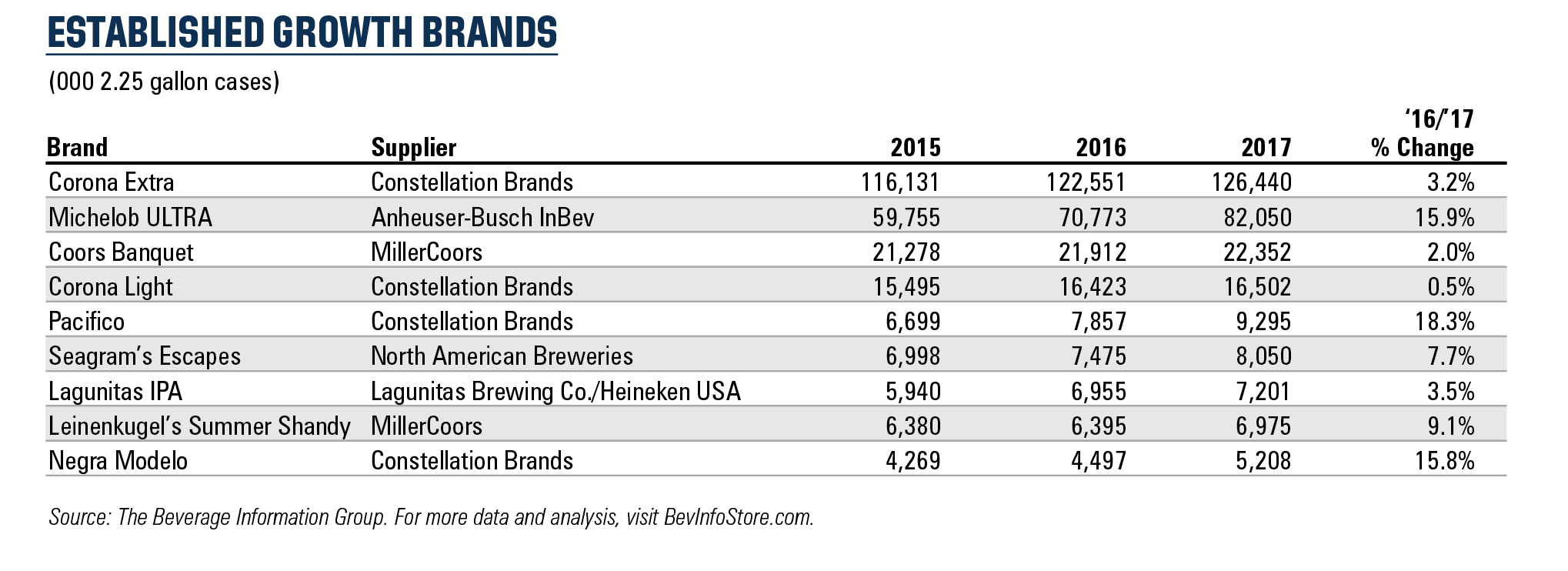

Although macro and craft overall faced issues, there were exceptions to the slowdown. Certain brands of Big Beer achieved growth in 2017, buoyed by savvy marketing and a loyal fan base. And several household-name craft breweries scored big with beers that attracted a wide audience with easily approached flavors.

The annual Beer Growth Brands recognize the brands that continued to show impressive sales figures. These are the brews that define what’s hot in the category. To read through their ranks is to know what today’s consumers most want from their beers.

Everybody Loves Mexican Beers

Among the most consistent growth areas in the category in the past few years have been Mexican imports. Mexican lagers have successfully appealed to consumers for being refreshing, approachable, craft and culturally authentic.

“Our rich, drinkable golden lager provides the refreshment Mexican lagers are known for, but a quality and a mystique that appeals to craft drinkers,” explains Matt Escalante, senior director, brand marketing for Pacifico.

Pacifico normally only advertises in western parts of America. Later this year the brand will market on national TV for the first time. Pacifico also has sponsorship ties to the U.S. Open of Snowboarding and X Games Minneapolis.

Suffice to say, Mexican brews have risen in popularity for reasons beyond their core cultural base. Their demo has become increasingly diverse — allowing for explosive growth.

“We’ve distanced ourselves a bit from the typical Mexican restaurants and put the brand into more general market on-premise accounts,” says Gustavo Guerra, brand director for Tecate Light.

“Our distribution push has targeted accounts where the hipster consumer segment congregates,” Guerra adds. “The brand is on fire in these accounts, showing excellent ROS and double-digit growth. Hipsters are in love with Tecate! They believe this brand is authentic Mexican and is proving to be their beer brand of choice.”

“Consumers continue to look for premiumization across categories,” says Corona’s John Alvarado, SVP, brand marketing beer division. “We’re seeing that in beer in general, and believe that Corona is well positioned to deliver not only a great product, but that premium consumer experience that they are looking for.”

Of course, Mexican brands have not lost track of their heritage. Like many of these brands, Modelo (from Constellation Brands) continues to market behind Cinco de Mayo and Día de los Muertos, along with soccer sponsorships and Michelada recipes.

“Our local sponsorships also lead to our on-premise success,” says Ann Legan, VP of brand marketing for Modelo. “We sponsor different local sports team and are develop strong on-premise activations that are relevant in our key markets.”

Corona’s programs for Cinco de Mayo included a celebrity influencer campaign with Josh Duhamel. It featured a “Lime Drop” using the NYE Ball at Times Square, a Snap Chat filter and a dedicated TV spot.

Spiked and Sparkling Products Take Off

The hard sparkling seltzer/water craze continued in 2017. These flavored malt beverages (FMBs) appeal to a broad array of consumers for being refreshing, convenient and light.

“At 90 calories per 12-oz. serving, Smirnoff Spiked Sparkling Seltzer is the perfect low-calorie beverage for any occasion,” says Krista Kiisk, brand director, Smirnoff Ice. “The combination of accessibility and low-calorie has made these drinks extremely appealing to consumers and will continue to drive the spiked seltzer trend.”

The brand’s lineup expanded in 2018 with Raspberry Rosé, which plays into U.S. consumer preferences for fruity flavors and rosé wine.

“The product has been very well received and has been flying off the shelves so fast that we are having to produce more cans than originally anticipated to meet demand,” says Kiisk.

“Drinkers are increasingly looking for options that can fit into a balanced lifestyle, and we see Truly Spiked & Sparkling fitting into this overall trend,” says George Ward, director of off-premise national accounts, Boston Beer Co. “The growth of non-alcoholic sparkling water is also a trend that shows no signs of slowing down. There is still significant opportunity to increase distribution and we expect to see a lot of growth for the category in the coming years.”

Elsewhere in the FMB category, Boston Beer’s Twisted Tea has continued to increase in sales.

“We’ve been brewing Twisted Tea since 2001 and the fact that we’re a growth brand all of these years later is a testament to our amazing loyal fan base and a great tasting hard iced tea,” Ward says. “In 2018, we’ll once again be focused on education and awareness, and getting drinkers to try Twisted Tea. We’ll be hitting the road again with our Twisted Tailgate Pro Tips RV Tour, allowing drinkers to try Twisted Tea at NASCAR events and country music concerts around the country.”

Approachable Craft Beers

Craft beer enthusiasts might prefer a barrel-aged stout, double dry-hopped NEIPA, or a 375-ml. of rare sour ale. Typically these are the top-scoring entries on BeerAdvocate or RateBeer. Aficionados aside, the craft beers bought most by consumers are approachable, sessionable and easy drinking.

“Not everyone wants big-flavored beers,” says Trent McCurren, VP of marking for Founders Brewing Co. “Plenty of people want beer that’s not challenging to their palate.”

Like the company’s All Day IPA. The trendsetting beer was among the first India Pale Ales to play into the sessionable trend. Sales have really taken off recently, doubling since 2015. This beer meant for everyone, from fanatic to newcomer.

“Craft beer has become accepted by more people who are now stepping into the category to see what it’s all about,” McCurren says. “All Day IPA is a great first craft beer for them to have.”

The brand will continue to host experimental, quirky activations, like oversized cornhole in their “Ultimate Session” programming, which engage consumers one-on-one with the brand.

Another craft beer that benefited from easy-drinking flavors is Deschutes Brewery’s Fresh Squeezed IPA. It taps into one of the hottest current flavor trends in craft beer. It has a “juicy flavor profile, naturally derived from a unique blend of citrus-forward hops,” explains Jeff Billingsley, Deschutes Brewery’s marketing director.

“In a sea of new options for consumers, with thousands of new offerings every year, Fresh Squeezed stands out from the chaos with a simple, straightforward proposition – a fresh, fruit-forward profile derived from whole cone hops,” Billingsley adds. “The name, the branding and the package all work together to let the consumer know what they can expect when they crack open a Fresh Squeezed.”

In the next year the brand will expand SKU offerings with 12-oz. cans for outdoor/active occasions, plus 19.2-oz. cans for single-serve sampling opportunities, focused on the c-store channel and sports/music venues.

“We’ll capitalize on the juicy, visceral experience that fans love about Fresh Squeezed, and bring it to life across a range of craft styles,” Billingsley says.

Macro Brands With Savvy Marketing

Not all Big Beer brands have receded in recent time. AB-Inbev’s Michelob Ultra continued its impressive gains in 2017. What’s behind this off-trend success? The marketers behind Michelob Ultra have perfectly positioned the brand for modern times.

Michelob isn’t a “lite” beer — it’s “ultra.” The beer is advertised towards consumers with an active/social lifestyle. Marketing depicts people working out together: running, hiking, bicycling, etc. This beer is ideal for such people, the ads argue, because it’s a “premium lager” with “low carbohydrates.” In other words, this is the low-carb beer for anyone who enjoys active social activities.

Coors Banquet was another macro winner, taking home an Established Growth Brand award. Founded in 1873, this classic brand has remained popular by never losing sight of its American roots in its positioning and marketing.

Can other Big Beer brands mimic this success moving forward? They will likely continue to launch new spiked seltzers/waters and buy up profitable craft breweries — following sales trends highlighted by our 2018 Growth Brands.

Kyle Swartz is managing editor of Beverage Dynamics magazine. Reach him at kswartz@epgmediallc.com or on Twitter @kswartzz or Instagram @cheers_magazine. Read his recent piece The State of Craft Beer, with Brewers Assoc.’s Julia Herz.