The Ready-to-Drink (RTD) product segment has seen significant growth each year with new entrants and innovation, due greatly to a new wave of consumers seeking convenient alternatives to fit their active lifestyles.

As a result, the quality of RTD products is increasing and more companies, including small-batch distilleries, are creating premium, natural products and moving away from the overly sweet offerings of the past.

Kevin Mehra, president and co-founder of Latitude Beverage Company, explains that sangria has seen double-digit growth in recent years, with the top four brands growing 43 percent between 2010 and 2013. Mija Sangria, in particular, has seen triple digit hypergrowth in the past year.

“Our first and only RTD innovation is Mija Sangria, a premium bottled craft sangria made with domestic dry red wine and 100% real, unfiltered fruit juice,” Mehra says. “Utilizing new and innovative flip top re-sealable packaging, Mija was created to provide consumers with immediate and convenient access to sangria that has the same quality, aroma and flavor typically found in homemade sangria.”

Latitude Beverage Company has just released a new canned wine brand called Lila Wines (pictured atop). It’s the first-ever Provence Rosé, New Zealand Sauvignon Blanc and Italian Pinot Grigio available in cans, which are designed with bright, pop art-inspired labels.

“The brand makes premium wine more accessible to consumers, where a typical glass bottle would not be convenient,” Mehra says.

According to John Eason, co-founder of Luchador Margarita Mix & Luchador Ready to Drink Margarita, while the category shows some growth, the margarita business within it is strong.

“The margarita is still king of the cocktail and tequila is more popular than ever,” Eason says. “Other major spirit brands are also entering the category as a means to create line extensions and keep visibility and trial on their brands. There are also new entries in packaging, such as bag-in-the-box and cans. With the resurgence of the cocktail culture, it’s also interesting to see how many craft cocktails there are in RTD form now.”

Eason and his team launched the Luchador Margarita Mix roughly nine months ago through a strategic partnership with Prairie Creek Beverages, led by industry veteran Mike Howard. “It’s been very successful despite having to change distributors mid-stream,” Eason says. “We will bring the Luchador RTD Margarita to the market in July. The iconic packaging was developed by the same design team responsible for Deep Eddy Vodka.”

Southwest Wines has produced Soleil Mimosa Classic (formerly branded St. Clair Mimosa), a pre-mixed Mimosa, for over 25 years. Long ago the company envisioned the need for a quality, pre-mixed, ready-to-drink cocktail, well before the consumer knew it.

“While our winery produces some fantastic varietal wines, we have chosen to expand our distribution nationally, and soon internationally, with our Soleil Mimosa brand,” says Sandra Pacheco, national sales director at Southwest Wines. “The RTD product segment has given our winery the opportunity to grow our sales and to establish great relationships with our retailers, distributors and, most importantly, our consumers.”

Since the introduction of its Soleil Mimosa Classic 750-ml. (fresh orange juice and premium white wine) 25 years ago, Southwest Wines has extended the brand with other popular fresh fruit flavors like mango, pineapple and pomegranate.

“Our marketing and development team researched the popularity of fresh fruit flavors and incorporated those flavors into our already popular Soleil Mimosa brand,” Pacheco says. “In addition, we were one of the very first wine suppliers to introduce a ‘wine in a can’ package. In 2012, Southwest Wines introduced Soleil Mimosa Mini in a convenient and sustainable 187-ml. aluminum can.”

Merrilee Kick, president of Southern Champion, agrees that the growth in RTDs has been substantial in the last few years, and that buyers are looking for unique products.

“We definitely have unique products, funny brand names and quality products—using real juice, real cream, that are kosher and gluten free. All of it takes time and money to make,” Kick says. “The consumer wants these and all RTDs at a bargain price. To make all of this happen, it means you have to have a scalable manufacturing line, a team with skills to invent and make a quality product and marketing teams to make it fun.”

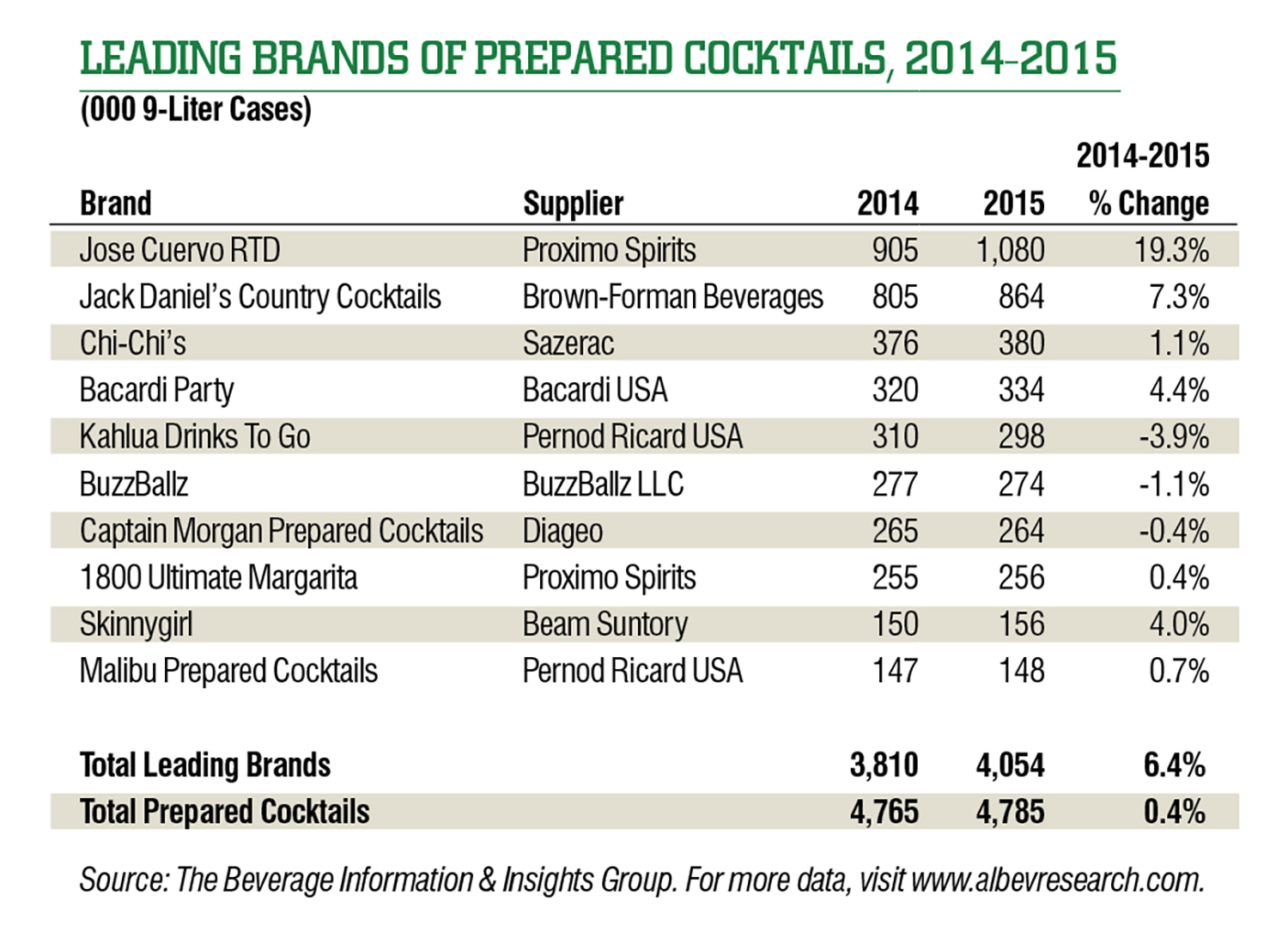

In the last two years, Southern Champion has grown its BuzzBallz portfolio of products to include “Shooterz”—a ready-to-drink shots line with pre-made popular shot flavors like birthday cake, lemon drop and jalapeno lime.

So how do ready-to-drink products match up against flavored spirits? Eason says consumers reach for RTDs for the sake of convenience.

“Many don’t know how to make a proper mixed cocktail or don’t want to go to the trouble,” Eason says. “They are also such a fantastic alternative to beer.”

In Pacheco’s opinion, the RTD category is going to continue to grow and will compete well with the flavored spirits category.

“There will always be consumers who prefer wine over spirits,” Pacheco says. “There is room and there are consumers for both wine and spirits RTD categories. Our Soleil Mimosa brand has established demand from traditional wine consumers; however, our product mixes well with added wine or spirits. Most importantly, it appeals to the ever-important Millennial generation.”

Mehra adds that while flavored vodka, particularly the confectionary flavors, boomed a few years ago, the category has seen a recent dramatic drop in sales.

“Consumers now prefer to blend their own flavors to make a bar-quality cocktail,” Mehra says. “Premium RTD products have a leg-up on flavored spirits since they provide convenience and ease of use. In addition, we are seeing a trend of consumers using quality RTDs that are made with real fruit as mixers in creative cocktails.”

Increasing Sales

Retailers interested in increasing sales on ready to drink products should offer them in the cold box, as well as display them in that section.

“That’s the space where people shop for convenience,” Eason says.

Pacheco’s advice is to display it conveniently for the customer, close to the register or where it has the most visibility. Cross-merchandising is extremely important, too.

“Retailers need to be creative when cross-merchandising RTDs with other products,” Pacheco says. “They must be forward thinking, envisioning what their customers will be looking for in order to capture sales of RTD products. With careful planning, retailers can capture some great sales.”

Latitude Beverage Company has found that the best way to increase sales and build a fan base for any new product (especially a RTD product), is to sample.

“Without knowing what something tastes like, many consumers are less likely to purchase, so there’s no better way to increase sales of RTD products than to have consumers taste it themselves,” Mehra says. “Retailers should also position RTDs in prominent locations during summer months, as it will create more excitement and curiosity surrounding the product, leading to impulse purchases.”

Kick also suggests making products look “fun” and putting the consumer in that mindset definitely plays a part in increasing sales.

Down the Road

Growing demand for more sophisticated flavors throughout the category is prompting a new wave of product innovation.

According to Mehra, there is a consumer shift towards products that are small-batch and handmade, so he anticipates seeing more craft distilleries bottling premium RTD cocktails.

“Based on our sales for Mija Sangria – 18,000 cases our first year and projected 50,000 cases this year – we anticipate seeing more growth in the coming years,” Mehra says.

Others agree that the future for RTD products continues to look promising. Eason says new, interesting flavor profiles are coming, as well as improved and alternative packaging.

“Look at the new and different labels in wine and beer,” Eason says. “To stay relevant the category must move that way. RTDs have been behind the times.”

Kick believes there will always be some sort of interest in ready-to-drink products, but it will constantly evolve. “People might want drinks that are portable versus cocktails prepared for the home,” Kick says. “People might want plastic versus glass containers. As society changes, suppliers need to listen and make adjustments.”

Pacheco also sees this category continuing to grow, as the Millennial generation reaches legal drinking age. “Convenience in packaging and quality formulation of product is critical to this generation,” Pacheco says. “The Millennials are socially and digitally connected, which provides instantaneous opportunity for sales of convenient, RTD brands. As long as the products meet or exceed the consumer’s expectations in taste profile, sales will continue to soar. Everyone wins.” BD

Maura Keller is a Minneapolis-based writer and editor. She writes for dozens of publications on a variety of business-related topics. When not writing, Maura serves as executive director of the literacy nonprofit, Read Indeed.