How hot are Ready to Drink cocktails (RTDs) in 2020? The category has grown 43% in global consumption this year, according to the IWSR, with U.S. consumers leading the charge. Moreover, the IWSR projects that global RTD volumes will post +21.8% compound annual growth between 2019 and 2024 (gaining share mostly from beer).

Many major companies have recently released their own takes on canned cocktails.

That’s a lot of winning for RTDs. Why have these premade drinks, typically canned, taken off in 2020? And what is fueling their massive growth potential ahead?

Premiumization and Mixology

RTDs have evolved considerably.

Several decades ago they were mostly sugary, made of unnatural ingredients and relegated to the bottom shelf. Now, RTDs have advanced into higher quality, tapping into the premiumization trend.

“We’re trying to offer an elevated beverage experience,” says Rocco Venneri, founder of the new RTD brand Cool Cat. These naturally flavored spritzers have a base of California pinot grigio, cane sugar and are gluten free. “Our wine is sourced from Napa and has a great foundation, taste and quality,” Venneri adds.

This ties into the broader consumer movement towards “better for you” products.

“Consumers are looking more now for what’s in products, what they’re putting into their bodies,” says Christopher Wirth, cofounder of Volley, a new, 100% blue agave tequila-based seltzer brand. Volley’s initial flavor lineup includes Zesty Lime, Spicy Ginger, Sharp Grapefruit and Tropical Mango.

“The health and wellness movement is playing out in the alcohol space,” Wirth says. “Using natural flavors is very important for RTD products. We use organic juice, sparkling water and high-quality tequila. We use no artificial flavors, no artificial ingredients. We found the highest-quality tequila that we could afford to put into our RTDs. We’re obsessive with our ingredient quality and transparency.”

The original selling point of RTDs is convenience. How easier it is drinking these products than mixing up cocktails in your own home. (Hence why RTDs now mostly come in cans.) But convenience alone is no longer enough for today’s consumers.

“People love the convenience, but want better quality from their RTDs,” says Brent Albertson, CEO of Zing Zang, which makes mixers and a new RTD line. “Everybody remembers those ‘90s-era RTDs, but it’s a whole new world now for RTDs. I don’t think people have a problem spending $15 on a pack of RTD cocktails.”

Part of this growth story owes to the 2020 lockdowns. With bars and restaurants closed or limited nationwide — and the pandemic keeping people home — consumers have missed out on genuine mixology.

“I think people still really love bartender-quality drinks, but don’t like to bartend themselves,” says Albertson. Making mixed drinks is messy, involves many ingredients and does not always turn out as desired, flavor-wise. “RTDs help answer that at-home-bartending question,” Albertson adds.

Agreeing with him is Wirth.

“A lot of this is consumers thinking, ‘What’s the version of my favorite bar’s cocktail in an RTD?” he says. “And it’s also, ‘What is clean, what is transparent with ingredients and what is real?’”

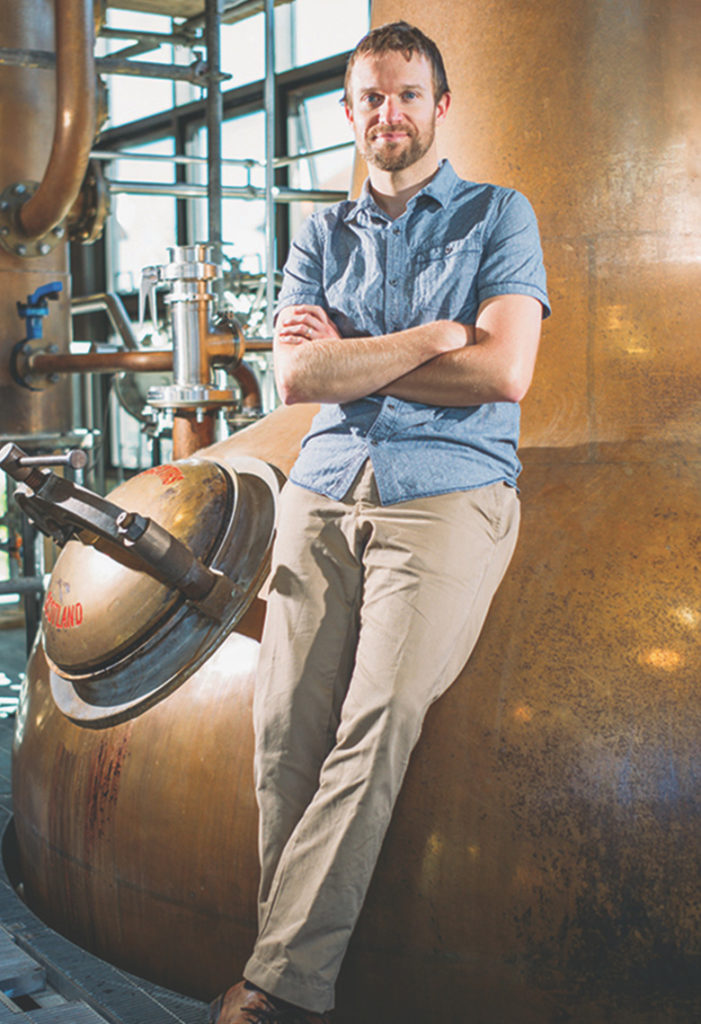

High West Distillery recently unveiled two new RTDs in glass bottles: a Manhattan and Old Fashioned, both barrel finished.

“We tried to achieve high-end bartender quality, straight out of the bottle,” says High West Master Distiller Brendan Coyle. “These are more expensive products, because we sourced only the highest ingredients.”

Hard Seltzer Alternative

The rise of premium RTDs is inseparable from the hard seltzer boom. The latter has become a gateway into the wider category of premium, clean-tasting, canned products.

While continuing its colossal growth, the hard seltzer category has also solidified around a few major winners. Outside of these mega-brands, the remainder of the category is a zillion lookalike competitors from producers of all sizes.

“Right now the hard seltzer space is very crowded with big brands and local breweries’ offerings,” says Carrie Shafir, General Manager, Blue Point Brewing. “So we felt less like jumping onto the hard seltzer bandwagon. We wanted to look more at what was next, at how we could help mold a category instead of jumping into an already-crowded landscape.”

Blue Point, owned by AB InBev, recently launched LIIT, a line of canned Long Island Iced Teas. Initial flavors include Mango, Lemon, and Raspberry Lime, all made with 100% real tea. LIIT also looks to capitalize on the consumer trend of variety.

“There’s a whole group of consumers out there who want more than what hard seltzer is giving them, but they don’t want to go full Twisted Tea,” says Shafir. “They want something that fits in the middle space. The biggest pain point for hard seltzer is lack of flavor and an artificial taste.”

“We’re using cane sugar and natural tear, so LIIT is not a sugar bomb. It’s subtly sweet,” she adds. “And tea has a lot of those better-for-you components.”

Notice how these RTD brands contain such diverse flavors and ingredients. Variety is key in this category.

“I think what’s happening is that younger people, Millennials especially, want options,” says Albertson of Zing Zang. “They grew up with all those Gatorade flavors. Millennials are used to having so many options, in a good way. They want variety.”

RTDs On-Premise, Post-Pandemic

Some day sooner than later, Covid-19 will recede, and crowds will return to bars and restaurants once again. This will be momentous for society — but perhaps bad for RTDs? After all, the category gained traction this year partly because consumers could not drink their favorite bartender’s cocktails.

But RTDs may not necessarily become a loser in the post-pandemic world.

“Cool Cat is going to be built on-premise once things lift again,” says Venneri. The brand is already available for purchase at high-end New York spots like The Standard Hotel, STK Downtown and Bottino.

“We’re not going to be in the bodegas and CVS and where a lot beer and hard seltzer brands are sold,” Venneri says. “This is an exploratory brand for consumers. I do think there will be a lot of pickup for RTDs at upscale on-premise. You can walk around with a canned cocktail at pool areas, country clubs and hotels.”

RTD producers also see a space for their products at beer festivals, once those return. After all, if you like craft beer or hard seltzer, odds are you would also enjoy the variety of flavor and convenience of canned cocktails.

“We’ve always prided ourselves on experiential marketing,” says Shafir of Blue Point Brewing. “We look forward to sampling LIIT at big beer events, with 3,000 to 5,000 people at a festival.”

When the pandemic ends, it’s unlikely that dominant consumer trends will suddenly shift. Especially those already established before the Covid-19 crisis. If anything, this bizarre year sped up many trends that were already emerging, or on the horizon.

“The ‘healthier for you’ trend started before the pandemic,” points out Coyle of High West. “Now everyone is paying even more attention to what they put in their bodies. I think that will continue after the pandemic. I think it will actually trend more. I think people will become even more picky about what they put into their bodies.”

Confusing Category?

Trends and market momentum both point towards growth ahead for RTDs. Nevertheless, one potential setback for the category is consumer confusion.

“There’s no clear line drawn between hard seltzers and RTDs,” says Wirth of Volley, which is tequila-based. “We’re slightly guilty of it ourselves. We define ourselves as hard seltzer on our cans.”

Why is that?

“When we were deciding how to categorize our brand, it came down to how we felt RTDs could be seen as cocktail, as heavier in ABV,” says Volley Co-founder Camila Soriano, “whereas Volley is a lighter beverage, fitting more in the hard seltzer category. We don’t think seltzer needs to be a malt-based category.”

The Volley co-founders do not believe that the FDA needs to step in and define “hard seltzer” versus “RTD.” Rather, the co-founders think that the onus is on brands in how they define themselves in the eyes of consumers. As long as brands are transparent about what’s in the drink, the Volley team thinks that customers will return.

“The biggest thing for us is educating the consumer,” says Venneri of Cool Cat. “We’re not a spiked seltzer. We’re in the cooler as an RTD, but standing out in quality. It will take some time to educate the consumer, who still looks at the category as an all-in-one.”

This is especially important when a 4-pack of Cool Cat wine spritzers costs $17.99.

“On our branding we try to hammer home why that’s a better value than buying a 6-pack of malt-based seltzer,” Venneri says. “We show how what our 4-pack represents in terms of a bottle of wine: how four cans equals two whole bottles. For a consumer who can afford a $15 or $20 bottle of wine, that sounds good to me. Part of our overall branding is to educate the consumer.”

“A can also reduces the waste involved,” he adds. “It’s a lot different than opening a bottle of wine on a Wednesday and then wasting the rest. RTD wine spritzers are great for people who want to drink casually.”

Higher-ABV RTDs

RTD cocktails like Cool Cat are also ideal for consumers who want a bit more oomph in their canned drink. These wine spritzers are 6.9% ABV.

“People are not going to be binge-drinking these like a 4.5%-ABV hard seltzer,” says Venneri. “But Cool Cat is only 150 calories at 6.9% ABV. There’s a value proposition there for the customer.”

And there’s an acknowledgement that not everybody wants low-cal, low-ABV all the time, despite the current buzz of those trends. Plenty of people still like alcoholic beverages that provide more of a kick, considering the retail cost.

Another reason why many RTDs have higher ABVs is the reality of production.

“We needed to get these to taste like how bartender-made cocktails taste,” says Albertson of Zing Zang, whose new RTD line clocks in at 9% ABV. “We tried 8%. We tried 7%, 6%, 12%. It was like the three bears: too soft or too hot. 9% had the best taste.”

Alternative Packaging

While cans have led the way for RTDs, products with alternative packaging also showcase the depth of variety in this category. (They also avoid the issue of the current aluminum shortage in America.)

For instance, those High West barrel-aged cocktails come in glass bottles.

“From a quality perspective, we don’t think there’s a lot lost by canning cocktails, but from a perception perspective, we do think something can be lost in terms of buyers viewing what is a high-end product,” says Coyle.

Cans also present a problem with shelf stabilization for certain cocktail recipes.

“High acid levels can eat away at the insides of a can, so there’s still work to be done on that side of production,” Coyle says.

Solving this problem will open the door for citrus-based canned cocktails in the future. In the meantime, canned citrus RTDs remain difficult to pull off.

Another brand that has embraced alternative packaging is Bartesian. Launched in 2019, this company sells a $350 mixing machine that makes drinks using individual capsules, made of recyclable plastic, that contain premade mixes of premium juice, bitters and other non-alcoholic ingredients. Simply add booze (or not, for mocktails) and enjoy.

Bartesian and its recyclable-plastic capsules ($2.50 each, or $14.99 per 6-pack) are already in 1,600 retail stores. Subscription options are available. “It’s an opportunity for consumers to have premium cocktails when they don’t have all the ingredients at home,” says Founder and CEO Ryan Close. “We can’t make these machines fast enough. We’re selling out immediately.”

“We were trending as a product before this pandemic hit,” he adds. “People were already staying in more with the rise of the Netflix lifestyle. This pandemic has only exacerbated what was already happening. People are obviously still going to go out, but I think that will be the exception versus the rule.”

One of the pioneers in alternative packaging is BeatBox Beverages. This wine-based punch gained fame on “Shark Tank” after earning a $1-million investment from Mark Cuban (his largest at the time). BeatBox comes in Tetra Pak.

Company founders see continued growth ahead for RTDs, despite potential consumer confusion.

“People don’t care about what kind of alcohol is inside their RTD,” says CEO Justin Fenchel. “The RTD movement has lines blurred. But people when they shop do so based on things like nutritional, or brand appeal. They care about the quality of the spirit used, or the quality of the grapes in the wine used, or whether the ingredients are all natural.”

BeatBox COO Aimy Steadman agrees. “Nobody really knows what alcohol is in many of these RTDs,” she says. “I’m really interested to see how this all evolves, especially with more sustainable ingredients. For us, we love seeing so much new innovation coming in.”

Correction: A previous version of this story said that Bartesian’s individual capsules were made of glass. In fact, the capsules are made of recyclable plastic.

Kyle Swartz is editor of Beverage Dynamics magazine. Reach him at kswartz@epgmediallc.com or on Twitter @kswartzz. Read his recent piece 5 Trends in Beer and Hard Seltzer in 2020-21.

[…] in 2020-21.The post Why RTDs Will Boom in 2021 and Beyond first appeared on Beverage Dynamics. Read Full Story at source (may require registration) Author: Kyle […]

[…] key players is beginning to limit the opportunity for new entrants in the space. That being said, Beverage Dynamics points out that the recent seltzer boom has opened up a gateway into the wider category of premium, […]

[…] the RTD boom continues, Connecticut-based canned cocktail brand ‘Merican Mule has announced a new seasonal release, […]

[…] “The tequila and ready-to-drink cocktail segments are two of the fastest-growing segments in the spirits category right now, with hard seltzer retail sales up 225% in the last year alone,” says Rashidi Hodari, managing director of Tequila at Beam Suntory. “With our pioneering history, we’re excited to seize this momentum and bring tequila and seltzer together to deliver a whole new Hornitos Tequila experience for those looking for a refreshing, premium ready-to-drink beverage.” […]

[…] 2020, pre-made cocktails changed the market: the IWSR observed a 43% growth in global consumption. Popular brands like Coors have already begun making their move on the […]

[…] and healthy beverages are on the rise, and no and low alcohol ready-to-drink offerings from North America to Europe and Asia-Pacific have boomed as they prove to be both a more […]

[…] the RTD category continues to boom, Fishers Island Lemonade has announced the launch of four new flavors: Spiked Tea, Pink Flamingo, […]

[…] comes as RTD cocktails continue to trend, following enormous growth in […]

[…] launch comes at a time when RTDs continue to trend following massive 2020 growth, and follows the recent release from Blue Point of Legalize […]

[…] latest entries in the booming Ready-to-Drink category are the Jim Beam Classic Highball and Jim Beam Ginger […]

[…] latest entries in the booming Ready-to-Drink category are the Jim Beam Classic Highball and Jim Beam Ginger […]

[…] of 2020 was the massive growth of ready-to-drink alcoholic beverages, as more consumers wanted premium cocktails while sheltering at home. Established Growth Brand winner Jack Daniel’s Country Cocktails benefited from this […]

[…] and you don’t have to be alone to enjoy them! Not surprisingly, the ready-to-drink market grew 43% in 2020, and is expected to be 20% alcohol e-commerce by […]

[…] need to be in quarantine to enjoy them! Not surprisingly, ready-to-drink cocktail sales grew by 43% in 2020, and they’re expected to be 20% of alcohol e-commerce by […]

[…] need to be in quarantine to enjoy them! Not surprisingly, ready-to-drink cocktail sales grew by 43% in 2020, and they’re expected to be 20% of alcohol e-commerce by […]

[…] quarantine to take pleasure in them! Not surprisingly, ready-to-drink cocktail gross sales grew by 43% in 2020, they usually’re anticipated to be 20% of alcohol e-commerce by […]

[…] need to be in quarantine to enjoy them! Not surprisingly, ready-to-drink cocktail sales grew by 43% in 2020, and they’re expected to be 20% of alcohol e-commerce by […]

[…] need to be in quarantine to enjoy them! Not surprisingly, ready-to-drink cocktail sales grew by 43% in 2020, and they’re expected to be 20% of alcohol e-commerce by […]

[…] need to be in quarantine to enjoy them! Not surprisingly, ready-to-drink cocktail sales grew by 43% in 2020, and they’re expected to be 20% of alcohol e-commerce by […]

[…] quarantine to take pleasure in them! Not surprisingly, ready-to-drink cocktail gross sales grew by 43% in 2020, they usually’re anticipated to be 20% of alcohol e-commerce by […]

[…] want to enjoy their favorite cocktails now more than ever,” says Britt West, VP and GM for Gallo Spirits. “With premium ingredients and convenient […]

[…] cocktails have been on fire for the past few years, further fueled by consumers staying home during the […]

[…] market reviews of the global drinks industry, changes are expected post-covid. Business has not been normal for many industries as well as the […]

[…] if the kid-friendly packaging wasn’t harmful enough, many of these cocktails offer higher alcohol content in order to get the same taste as bartender-crafted cocktails. According to the Distilled Spirits […]

[…] in popularity. Combined with hard seltzer and other ready-to-drink offerings, the category grew 43 percent in 2020 across the globe and is expected to surpass $146 billion in sales by 2030 in the United States […]

[…] in popularity. Combined with hard seltzer and other ready-to-drink offerings, the category grew 43 percent in 2020 across the globe and is expected to surpass $146 billion in sales by 2030 in the United States […]

[…] in popularity. Combined with hard seltzer and other ready-to-drink offerings, the category grew 43 percent in 2020 across the globe and is expected to surpass $146 billion in sales by 2030 in the United States […]

[…] in popularity. Combined with hard seltzer and other ready-to-drink offerings, the category grew 43 percent in 2020 across the globe and is expected to surpass $146 billion in sales by 2030 in the United States […]

[…] in recognition. Mixed with exhausting seltzer and different ready-to-drink choices, the class grew 43 percent in 2020 throughout the globe and is predicted to surpass $146 billion in sales by 2030 in the USA […]

[…] includes the hard seltzer boom, the rise of RTDs, the golden age of American whiskey and the current shortage of glass and aluminum packaging. […]

[…] and healthy beverages are on the rise, and no and low alcohol ready-to-drink offerings from North America to Europe and Asia-Pacific have boomed as they prove to be both a […]

[…] Per the IWSR, the US leads the charge when it comes to demand for RTDs. North America as a whole is driving growth. […]

[…] Flavored Malt Beverages (FMBs), up an incredible 68.1% in 2020 to 306 million 2.25-gallon cases. This is thanks largely to the RTD boom. Hard seltzer brands are paving the way in this category, increasing by 152.9% […]

[…] the most dominant trend in the past year was the meteoric rise of ready to drink beverages. This includes Rising Star winner, Jack Daniel’s Can […]

[…] and wholesome drinks are on the rise, and no and low alcohol ready-to-drink choices from North America to Europe and Asia-Pacific have boomed as they show to be each a extra handy […]

[…] and healthy beverages are on the rise, and no and low alcohol ready-to-drink offerings from North America to Europe and Asia-Pacific have boomed as they prove to be both a […]

[…] 2020, pre-made cocktails changed the market: the IWSR observed a 43% growth in global consumption. Popular brands like Coors have already begun making their move on the […]