Alcohol retail technology boomed during the pandemic. Growth rates for these ecommerce companies spiked, with many reaching triple digits. Fueling this was a large number of consumers, stuck at home, who realized for the first time that they could buy alcohol online.

The question now is: what next?

“There is a lot of room for growth in beverage alcohol ecommerce,” says Erynn Petersen, chief technology officer at Drizly. “Alcohol online is where fashion and cars were five years ago in ecommerce — on the edge of breaking out, with digital experiences catching up to what consumers need in these commerce experiences.”

A pioneer in digital delivery, Drizly was acquired by Uber in early 2021. The deal foreshadows continued consolidation, growth and innovation for alcohol ecommerce.

“We are excited to be working towards Drizly’s integration within the Uber Eats app,” says Petersen. “We’ll maintain a standalone web and app experience and through our singular focus on beverage alcohol.

“We’re working on a number of new initiatives at this time,” she adds, “including a deeper dive into personalization, identifying more opportunities to create greater value for our consumers and enabling easier discovery and search.”

Much of this depends on collecting and utilizing consumer data, which becomes exponentially more critical as ecommerce explodes.

“Thirstie has seen firsthand the impact consumer data has had on the brands we work with,” says Thirstie CEO Devaraj Southworth. “We not only arm our brand partners with first-party data, but also provide tools to understand how they can apply data to their marketing efforts and increase traffic to their digital stores.”

“The more we can ‘connect the dots’ around consumer behaviors pertaining to e-commerce, the more the entire bev-alc industry can accelerate in the digital world,” he adds.

But that is more difficult after recent privacy changes for products like iPhones, making people harder to track.

“The writing has been on the wall the last couple of years as the effects of privacy continue to evolve,” says 3×3 CEO Mike Provance. “And shoppers are getting smarter. They want information useful to them. They don’t want to get slammed with spam. They want genuine interactions with alcohol products. That’s who we’re targeting and curating.”

3×3, which specializes in data-driven marketing programs for retailers, is now looking beyond cellular apps.

“We’ve seen a downward trend in people using apps because people are inundated with apps,” Provance says. “Our approach is leveraging what’s native in the phone. Text messaging, mobile web, e-wallets.”

Businesses that do not adapt accordingly may find themselves in trouble as technology evolves.

“I think the most important thing is that many liquor stores don’t realize how much they’re under attack,” says Elie Y. Katz, president and CEO of POS-provider National Retail Solutions (NRS). “In the past, liquor stores were threatened by brick-and-mortar businesses like Costco and Walmart. Now, delivery and online sources are working hard to prevent people from going into stores in the first place.”

“That’s why it’s so important for liquor stores to get the right technology and start pivoting,” he adds.

NRS itself is pivoting — in a market still stricken by pandemic-caused distribution issues — into logistics options. “We’re going to get more involved in point-to-point deliveries,” Katz says.

In a post-Covid world, businesses are also under attack from a staffing shortage.

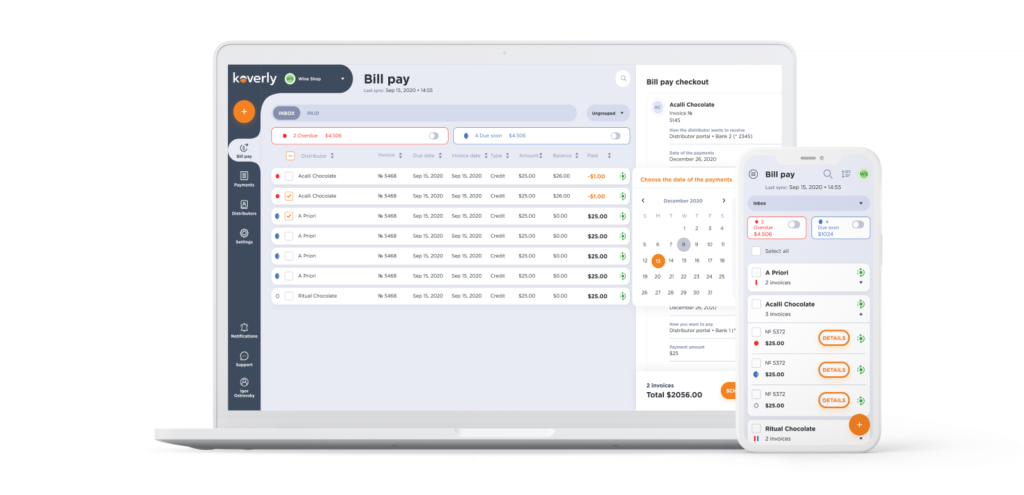

“Staffing challenges that have long plagued beverage alcohol retail are exacerbated post-pandemic with stores struggling to build back the in-store staff they lost during the pandemic,” says Igor Ostrovsky, co-founder and CEO of Koverly, a B2B-payment solution. “Many businesses need to ask more of the employees that remain.”

“Right now, businesses need technology solutions that reduce tasks, increase efficiency and position them for sustainable, healthy growth,” he adds. “The Koverly platform connects to distributor payment portals, pulling invoice details from multiple distributors and suppliers into one dashboard and providing beverage alcohol business owners a single workspace to manage all of their bills and payments.”

How consumers interact with brands has also changed dramatically in the past few years. It’s no longer enough for a brand to simply post informative or entertaining social media content. Savvy companies now leverage digital interactions and data to form more personalized relationships with customers.

“At Drizly, we realize the importance of understanding what our customers want and need,” says Petersen. “For example, if a customer loves stouts, they should never have to wade through IPAs. Drizly is building a deep, rich catalog on our standalone app and website of all things bev-alc, and applying what we are learning across millions of users to deliver a personalized experience to each individual consumer.”

Perhaps the greatest question moving forward is where exactly alcohol ecommerce operates within the three-their system. This remains a murky answer.

“We believe that commitment to compliance will eventually come to the forefront of alcohol retail technology,” says Southworth of Thirstie. “As e-commerce is a new ‘fourth tier’ within the alcohol ecosystem, it’s quite complex for brands to understand what is compliant and what isn’t. Thirstie has put compliance front and center, and has made it a point to meet directly with state regulators to understand how to build a compliant solution.”

As alcohol ecommerce continues to expand, and the companies continue to consolidate, more businesses will need help navigating these new legal and business challenges.

“We are still experiencing a swell of bev-alc retailers coming online for the first time, and Drizly’s technology and support teams help minimize what might be a daunting leap to selling online by automating compliance and regulation,” says Petersen. “This includes tools that take care of sales tax calculation based on a delivery address, compliant payment flow of funds, promotions and discounting, and ID verification at the doorstep.”

“While we have a strong base of retailers who understand how to serve their local online buyers, we’re also looking at what tools make it even easier for smaller retailers to move into the online delivery space,” she adds.

In the years ahead, forever shaped by the pandemic, the world will likely become increasingly reliant upon technology. With more consumers now fluent in ecommerce, implementing the right tech has never been more important for beverage alcohol retailers.

Kyle Swartz is editor of Beverage Dynamics. Reach him at kswartz@epgmediallc.com or on Twitter @kswartzz. Read his recent piece, The Top Alcohol Retail Tech for 2021-22.