Distilled Spirits sales continued their two decades of steady increases in 2018, with whiskey sales continuing to rise among all sub-categories.

This year’s list of Growth Brands winners includes 71 spirit brands in four categories: Rising Star, Fast Track, Established Growth and Comeback. Together, they represent more than 74 million 9-liter cases sold.

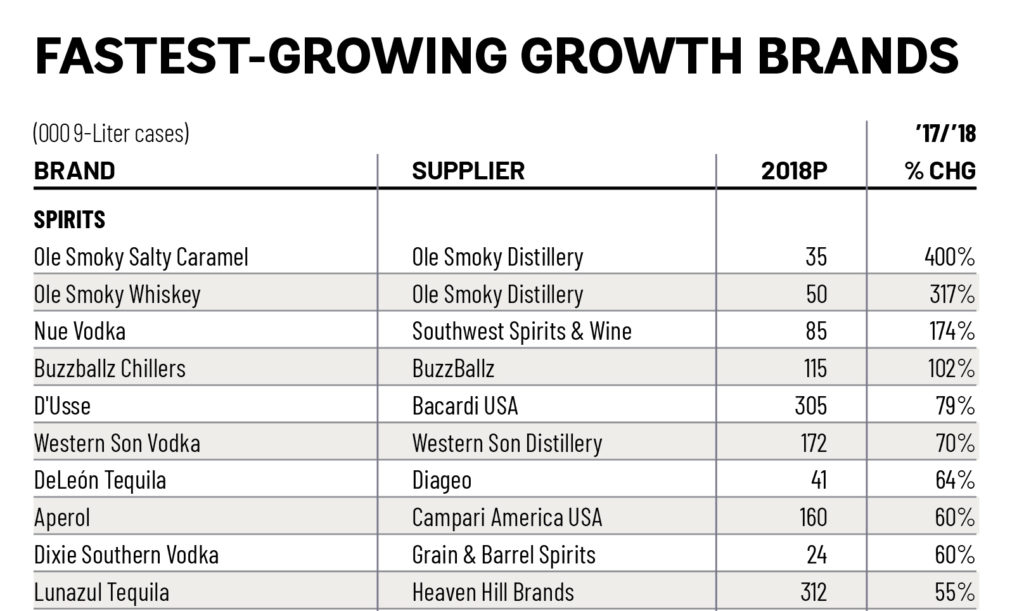

The largest brands at the list are as diverse as Tito’s Vodka (which grew more than 20% last year), Crown Royal, Jack Daniel’s and Fireball. Some of the fastest-growing brands are much smaller but notable, including two brands from Ole Smoky, Western Son Vodka and DeLeon Tequila.

This year’s Spirits Supplier of the Year, Brown-Forman (repeating from 2018), had ten brands on the list. More will be said about those winners in the next issue.

How did these winning brands achieve their sustained success needed to make our Growth Brands list? A combination of successful marketing, increased distribution, unique activation programs on- and off-premise and generally tapping into consumer trends at the right time.

The Beverage Information & Insights Group (research arm of Beverage Dynamics) selected this year’s winners using the following criteria, based on brands’ projected case sales for the 2018 calendar year:

» Established Growth Brands are top sellers in their category, at least five years old, and moved a minimum of 400,000 9-liter cases in 2018. They have also grown sales over each of the last three years.

» Rising Stars are less than five years old and have grown each year of their existence, reaching at least 20,000 9-liter cases in 2018.

» Fast Track Brands are at least five years old, and have exceeded 100,000 9-liter cases sold in 2018, with double-digit growth in each of the last three years.

» Comeback Brands are previous winners that have rebounded in sales to at least their previous winning level, following a recent decline.

A World of Whiskeys

You can’t talk about growth within the spirits industry without emphasizing how much whiskey brands are expanding.

New brands are entering the market, existing brands are branching out with new expressions, aging processes and finishes, and consumers just can’t get enough.

“We see consumers drinking across categories in whiskey, particularly in social occasions,” says Tullamore DEW Brand Manager Conor Neville. The William Grant & Sons brand was a Fast Track winner this year for its nearly 20% growth. “Consumers are becoming more engaged with an increasingly accessible Irish category as it opens its doors to new audiences, occasions and rituals. We’ve seen a decade of double-digit growth and there are no signs of anything slowing down.”

Irish category leader Jameson, which entered the Growth Brands Hall of Fame last year, is a Fast Track winner again this year, with nearly 3.5 million cases sold.

“Last year Jameson launched the ‘Love Thy Neighborhood Block Party,’ a program that gives back to local communities across the country,” says VP Paul Di Vito. “The events support Keep America Beautiful, with the tour kicking off in San Diego and continuing to Austin and Nashville. We celebrated the features of these cities with local food vendors, brewery partners and local musicians.”

One of the highest-selling brands on this year’s list of winners, Diageo’s Crown Royal, has continued to expand its portfolio of flavors and expressions, as well as its charitable giving. The brand was an Established Growth winner once again, with nearly 6.3 million cases sold.

“Consumers want to feel good about the brands they support, and brands are expected to contribute to the greater good in society,” says Brand Director Nicky Heckles. “With initiatives such as the Purple Bag Project, which aims to send 1 million care packages to troops serving overseas and those affected by national disasters by 2020, as well as the Crown Royal Water Break, a movement that encourages responsible game day consumption, we resonate with consumers through our generosity and social responsibility.”

Within the larger whiskey category, rye has stood out as a bright spot to watch in coming years. Jack Daniel’s Tennessee Rye Public Relations Director Svend Jansen calls the rye category “very hot.” Tennessee Rye was a rising star this year, rising nearly 10% to 35,000 cases in its second year.

“We’re benefiting from rye’s recent resurgence and adoption from consumers and bartenders,” Jansen says. “It’s a bold and spicy spirit that’s versatile and stands up nicely in classic cocktails.”

Beam Suntory’s Knob Creek has also benefited from a rye variant within its portfolio. The original brand was an Established Growth winner for its 450,000 cases sold in 2018, and has seen its portfolio of expressions grow over the years.

“The award-winning Knob Creek Rye continued to stand out as a bartender favorite for classic whiskey cocktails like the Old Fashioned,” says VP of Whiskey for Beam Suntory Rob Mason. “The brand’s success off-premise was strengthened by variants within its rye portfolio – the introduction of Knob Creek Single Barrel Rye and the limited releases of Cask Strength Rye and Twice Barreled Rye.”

Cordials, Liqueurs and Flavor

Flavored spirits continue to drive sales, and while exotic flavors that were all the rage a decade ago haven’t come back yet, traditional flavors are doing very well. Cinnamon-flavored whisky Fireball surpassed 5 million cases for the first time in 2018, earning it another Established Growth win.

“Our success is based on the devotion and support of our Fireball nation,” says Senior Marketing Director Becky Henry. “Fireball fans continue to love igniting the night!”

Cinnamon has also worked well for Jack Daniel’s, which has both Tennessee Fire and Tennessee Honey on this year’s list as a Comeback Brand and Established Growth brand, respectively.

“Our official partnership with the NBA has created great excitement for JD Tennessee Honey and has helped us reach new friends of Jack,” Jansen says. “We’ve also worked on a program called ‘neighborhood flavors,’ which celebrates the culture and creativity of five unique communities around the U.S.”

“The Tennessee Fire ‘Rise from the Fire’ cause-marketing program was something that helped drive awareness and buzz around the brand,” he adds, “along with our ‘Gather Round the Fire’ media campaign earlier in the year.”

Traditional liqueurs have dropped as a category thanks to flavored spirits and the mixology trends surrounding natural flavorings, but Grand Marnier earned another Comeback Brand win this year for its 1.2% growth to more than 522,000 cases.

“During the summer we brought consumers what they wanted during warm months – refreshing cocktails,” says US Category Director of European Icons for Campari America Lana Kouznetsov. “We dialed in on the Grand Margarita for Cinco de Mayo and our Grand Collins – a low-ABV alternative for at-home entertaining. During the holidays, we focused on in-store displays to show how gift-worthy our bottle truly is.”

Grown South of the Border

“Rising interest in tequila cocktails can be largely attributed to bartenders’ experimentation with tequila cocktails on-premise,” says Sauza Senior Marketing Director Matt Plumb. The Beam Suntory brand is an Established Growth winner in 2018, selling more than 2.5 million cases. “Leveraging the refreshment trend on-premise, we activated several ‘poptail’ executions showcasing tequila’s flexibility in frozen form,” he adds.

In its first full year as a Diageo brand, Casamigos grew 50% to more than 250,000 cases in 2018. “We’re seeing people drinking Casamigos that never tried tequila before,” says CEO Lee Einsidler. “Consumers want the best, and they appreciate the authenticity and quality of Casamigos.”

Campari’s Espolon Tequila highlighted its Mexican roots in 2018, utilizing label artwork to pay tribute to 19th-century artist and printmaker Jose Guadalupe Posada, who used his art to comment on social injustice.

“We also highlighted our authentic Mexican roots by launching a Day of the Dead roaming altar, allowing our consumers to interact with the brand in a completely unexpected way,” says Category Director of White Spirits Bernadette Knight. “We’re focused in 2019 on driving distribution and increasing consumer awareness.”

Other Notable Winners

While Tito’s dominates the headlines when talking about vodka, it’s far from the only winner in the category on our Growth Brands list. Fast Track brand Deep Eddy, which was acquired by Heaven Hill a few years ago, is driven by partnerships with Southwest Airlines, music festivals like SXSW and other brands that fit within the brand’s “Authentic American” lifestyle.

“Vodka continues to be the largest category in the spirits business and Texas premium vodka has experienced exceptional growth over the last several years,” says Matt Krocheski, Marketing Director for Fast Track winner Western Son Vodka. “We’re continuing to build our footprint on-premise with our signature cocktail and mule programs. Consumers continue to search for authentic, crafted brands with unique offerings.”

Zach Brinley, Chief Bootlegger of Brinley Gold Shipwreck rum (a Rising Star for the third straight year), agrees. “We’ve been helped tremendously by the overall move by consumers to premium and craft brands,” he says. “We know that rum – especially infused rums – has a lot more room for growth. We rely heavily on off-premise tastings, and our flavors have always been the key to sales, leading us to many fans.”

Heaven Hill’s Admiral Nelson, a perennial Established Growth Brand, is another rum doing well in a lackluster overall category.

“Rum has the second-highest impulse purchase rate of all spirits,” says a brand manager. “We’ve seen spiced and traditional flavors perform well as consumers and brands return focus to the basics for the category. Our pineapple exceeded expectations when it launched in 2018, and we look forward to launching our watermelon flavor nationally in 2020.”

Jeremy Nedelka is Content Director for Beverage Dynamics magazine. Reach him at jnedelka@epgmediallc.com.

[…] Dixie Southern Vodka which Anttila created from scratch and which won of a 2019 “Rising Star” Growth Brands Award from the Beverage Dynamics magazine. The latter is the largest premium craft vodka brand produced […]

[…] High West. Purchasing whiskey from various distilleries and combining them into unique blends, this fast-growing brand has released some of the most popular expressions on the market today. And while other companies […]

[…] for Jameson to make itself more attractive to Americans. Yes, the brand is growing rapidly, with a 10.1% increase in volume sales between 2017 and 2018, according to the Beverage Information & Insights Group. And yes, […]

[…] for Jameson to make itself more attractive to Americans. Yes, the brand is growing rapidly, with a 10.1% increase in volume sales between 2017 and 2018, according to the Beverage Information & Insights Group. And yes, […]

[…] all you want, Fireball has earned its spot on a bucket list bourbon sheet by sheer force. And though it is not technically a whiskey, it is the ground floor entrance for millions of […]

[…] all you want, Fireball has earned its spot on a bucket list bourbon sheet by sheer force. And though it is not technically a whiskey, it is the ground floor entrance for millions of […]

[…] whatever you want, Fireball has earned its place on a list of bourbon buckets in the only force. And while it’s not technically a whiskey, it’s the ground floor entrance for millions […]

[…] of NASCAR; one of the fastest-growing craft brands in the United States, Dixie won prestigious 2019 and 2020 “Rising Star” Growth Brands Awards from Beverage Dynamics magazine. Other […]

[…] of NASCAR; one of the fastest-growing craft brands in the United States, Dixie won prestigious 2019 and 2020 “Rising Star” Growth Brands Awards from Beverage Dynamics magazine. Other […]

[…] of NASCAR; one of the fastest-growing craft brands in the United States, Dixie won the prestigious 2019 and 2020 and 2021 “Rising Star” Growth Brands Awards from Beverage Dynamics magazine. Other […]

[…] of NASCAR; one of the fastest-growing craft brands in the United States, Dixie won the prestigious 2019 and 2020 and 2021 “Rising Star” Growth Brands Awards from Beverage Dynamics magazine. Other […]

[…] Vodka, the leading premium homegrown vodka produced in the Southeast, having won the prestigious 2019 and 2020 and 2021 “Rising Star” Growth Brands Awards from Beverage Dynamics magazine; High Goal […]

[…] and one of the fastest-growing craft brands in the United States, having won the prestigious 2019 and 2020 and 2021 “Rising Star” Growth Brands Awards from […]