In Part 2 of our 2020 Growth Brands Awards, following spirits last week, we look at the fastest-growing wine brands in America.

After 25 consecutive years of growth, total wine consumption fell 0.6% in 2019, according to preliminary figures from the Beverage Information and Insights Group (BIIG). While it may be a scant decrease, with Baby Boomers drinking less overall and Millennials increasingly turning to spirits, cocktails, hard seltzers, non-alcoholic beer and other beverages, selling wine has become more challenging.

That means winning a Wine Growth Brand in 2020 is a pretty big deal. How did these brands manage to grow in 2019?

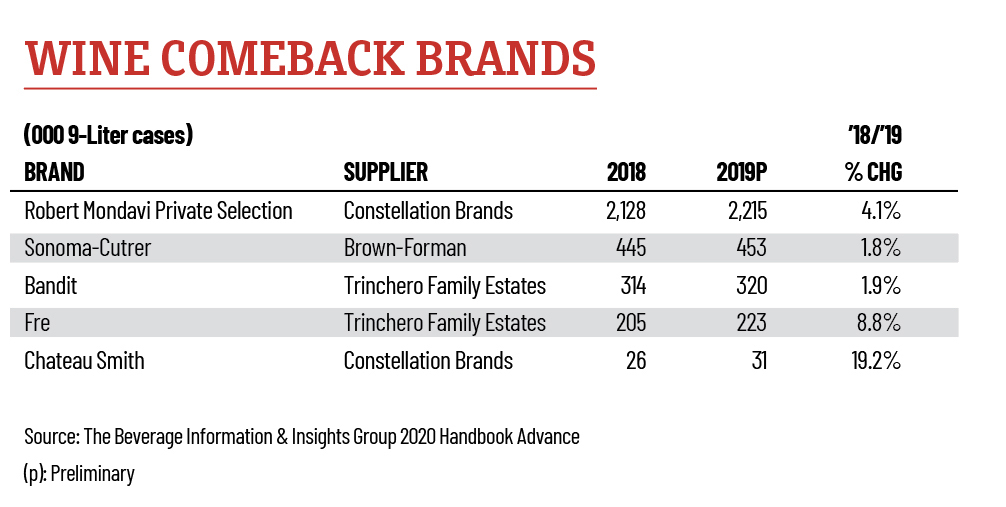

Savvy brands watch trends carefully and look for opportunities. “Multiple trends are impacting the superpremium wine category, and we are closely monitoring and incorporating them into our plans,” says Sonoma-Cutrer’s senior brand manager Tracy Thornsberry.

“First, we know consumers are continuing to trade up,” she says, “which is great for brands like Sonoma-Cutrer.” The Comeback Brand winner, which focuses on chardonnay and pinot noir, uses a unique chilling tunnel to air cool its grapes; the wines age in barrels made of specific French oak trees that are individually selected to the winemakers’ needs.

“We also know, however, that the premiumization trend has slowed in recent years, so we have to work smarter to continue capturing consumers’ attention,” Thornsberry notes.

What’s more, the entire industry is trying to attract Millennials, “a cohort that is not adopting wine at the same rate as previous generations,” she adds. “For us, the key is connecting with them—being relevant to them—while staying true to who the brand is and what it stands for.”

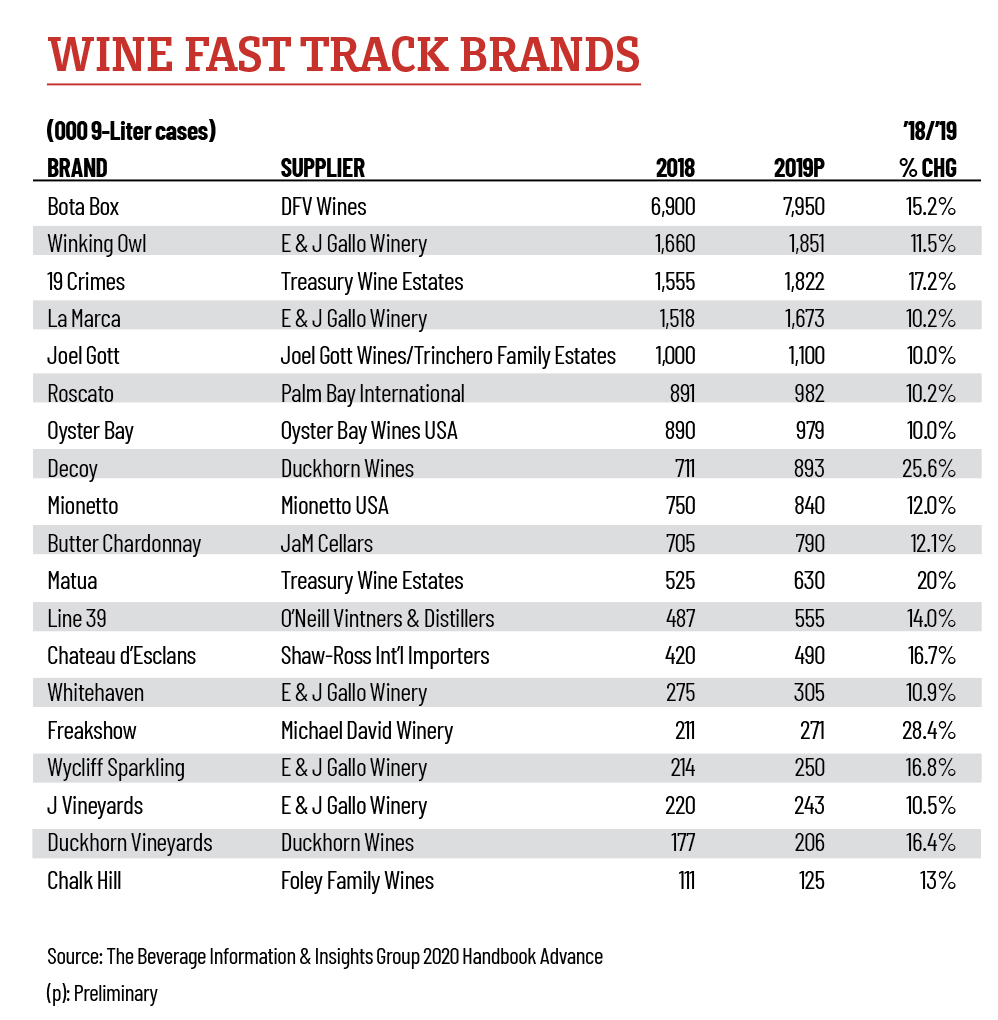

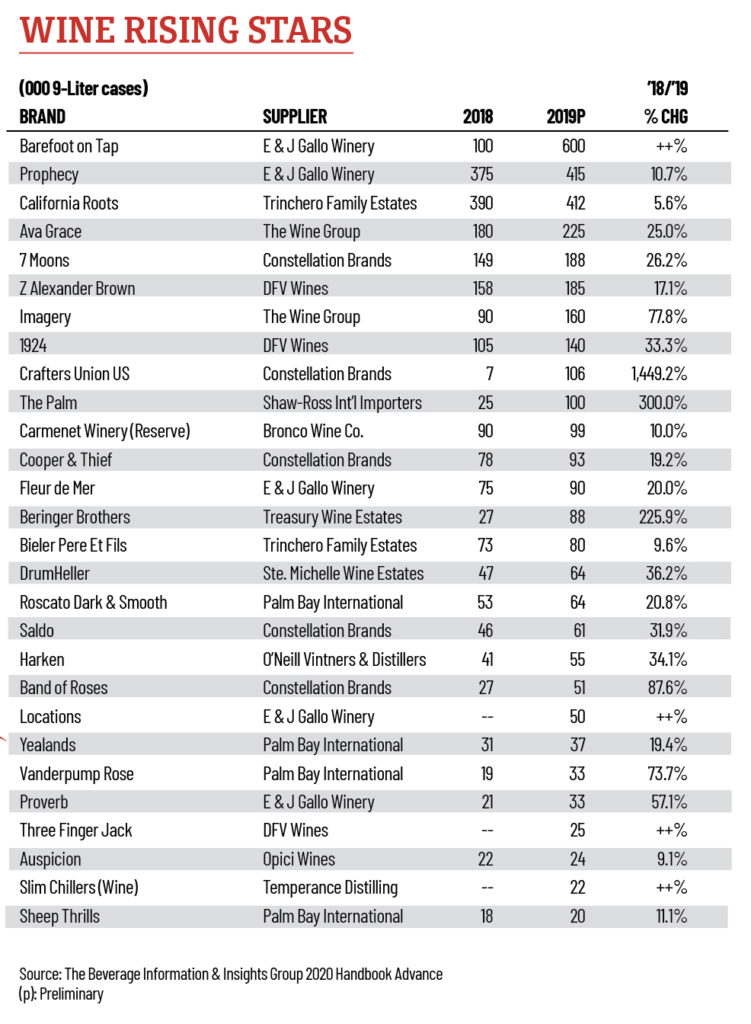

Growth Brands Category Definitions

» Established Growth Brands are top sellers in their category, at least five years old, and moved a minimum of 400,000 9-liter cases in 2018. They have also grown sales over each of the last three years.

» Rising Stars are less than five years old and have grown each year of their existence, reaching at least 20,000 9-liter cases in 2018.

» Fast Track Brands are at least five years old, and have exceeded 100,000 9-liter cases sold in 2018, with double-digit growth in each of the last three years.

» Comeback Brands are previous winners that have rebounded in sales to at least their previous winning level, following a recent decline.

Rosé Glow

Despite industry challenges, there are bright spots. The rosé boom, for one, hasn’t faded. A number of our Rising Stars brands specialize in rosé, including The Palm by Whispering Angel from Chateau d’Esclans; Fleur de Mer from E & J Gallo Winery; Bieler Pere et Fils Rose from Trinchero Family Estates; and Band of Roses from Constellation Brands.

While rosé sales continue to spike around the warmer months, the style has also found a following among drinkers year-round, says Marina Velez, manager of information services for BIIG. Rosé at $15+ per bottle price points has showed strong growth, with premium offerings comprising more than 20% of the category volume, she says.

Vanderpump Rosé was launched by TV personality/restaurateur Lisa Vanderpump—best known for her appearances on Bravo’s The Real Housewives of Beverly Hills and Vanderpump Rules—and her family in 2017. The Provence rosé blend of cinsault, grenache and syrah sold 33,000 9-liter cases in 2019—an increase of 74%.

The success of the imported rosé category as a whole, itself led by premium rosé from Provence, “has provided an opportunity for well-positioned brands to lead growth and innovation by delivering a superior consumer experience,” says Peter Willcock, director of brand development for Vanderpump’s importer Palm Bay International.

Consumers today are drinking more high-quality dry rosé than ever before, “and Vanderpump Rosé delivers exceptional quality, supported by instant name-recognition that’s synonymous with authenticity and good taste,” Willcock says.

The brand has fostered relationships with some of the nation’s best-known restaurant groups and independent operators, he notes. It helps that Vanderpump and husband Ken Todd own 28 bars and restaurants, including the Jewel Bar and Shadow Lounge in London, Villa Blanca in Beverly Hills, and SUR and PUMP Restaurant in West Hollywood. “We’ve selected on-premise partners who share the brand’s integrity and the family’s passion for exceptional quality,” Willcock says.

Off-premise, Vanderpump Rosé’s unique and aspirational consumer appeal “has delivered encouraging velocities to retailers from both the floor and shelf positions,” he says. Engaging point-of-sale, elegant packaging and a price point (about $16 for a 750-ml. bottle) that reflects the product quality and value have led to consumer satisfaction and loyalty.

Sparkling Sales

The Champagne and Sparkling Wine category is projected to see a 3.8% increase in volume consumption growth in 2019, says Velez of BIIG, marking the 18th consecutive year of growth since 2002. Imported Champagne brands drove the majority of the segment’s growth, but prosecco remains strong.

Zonin, perhaps best known for its prosecco, posted a 15.4% gain for 2019, reaching 571,000 cases. That’s the biggest percentage increase of all the Establish Growth brand winners this year.

Mionetto prosecco, a Fast Track winner again, managed a 12% increase in 2019 to 840,000 cases. Popular prosecco brand La Marca has seen its growth slow from 29% in 2018 to 10.2% in 2019. Still, the Gallo brand sold nearly 1.7 million cases of the sparkler. La Marca and Establish Growth brand Ruffino both made the list of Highest-selling Growth Brands.

E & J Gallo’s J. Vineyards uses traditional method winemaking techniques in its sparkling wines that include hand-harvesting and hand-sorting the grapes. The brand, which also includes chardonnay and pinot noir still wines, was up nearly 11% in 2019.

And William Wycliff, Gallo’s “California Champagne” brand, earned another Fast Track award thanks to a 17% increase to reach 250,000 cases in 2019.

Sauvignon Story

Chardonnay is still the most popular varietal, according to The State of the Wine Industry Report 2020, authored by Rob McMillan, executive vice pres- ident and founder of the Silicon Valley Bank wine division, but it’s not grow- ing. Sauvignon blanc, however, is a varietal that’s on the rise, and that’s evidenced by several Growth Brand winners this year.

Matua wine, which produced New Zealand’s first sauvignon blanc in 1974, saw 20% growth in 2019, to reach 630,000 cases. Established Growth Brand winners Kim Crawford and Starborough and Fast Track Brand Oyster Bay are also known for their New Zealand sauvignon blanc.

Yealands is outpacing the New Zealand sauvignon blanc category’s strong growth, says Willcock of Palm Bay International, which imports the wine. The Rising Star brand, which sold 37,000 cases in 2019—a 19.4% increase—enjoyed a stellar 2019 in the on-premise channel, he notes, performing particularly well as glass pours in several restaurant chains. The fresh wine style, paired with great value and product reliability, appeals to restaurant buyers and guests.

It also helps that U.S. consumers are more interested in sustainably produced and environmentally friendly products. “As New Zealand’s leading environmentally sustainable winery and the world’s first to be certified carboNZeroCertTM since inception, Yealands proudly embraces a holistic approach to sustainability that benefits both the environment and the quality of its wines,” Willcock says.

Popular American producers of sauvignon blanc that won Growth Brands include Rising Star Imagery and Fast Trackers Joel Gott, Decoy and Duckhorn Vineyards, among others. Beringer Brothers, known for its bourbon-barrel-aged wines, in March 2019 introduced sauvignon blanc aged in tequila barrels. The Rising Star brand from Treasury Wine Estates increased a whopping 223% in 2019, to 88,000 cases.

Red Red Wines

Cabernet sauvignon and red blends remain popular with consumers, and winemakers aim to deliver unique new offerings. For instance, Delicato Family Wines last summer unveiled Three Finger Jack East Side Ridge cabernet sauvignon from Lodi, CA. Inspired by the legend of a local outlaw during the Gold Rush days, according to Delicato Family Wines founder Cheryl Indelicato, Three Finger Jack sold 25,000 cases in 2019.

Cooper & Thief, a spirits-barrel-aged wine from Constellation Brands, started with a red blend and a cabernet sauvignon. The Rising Star brand, which two years ago released a sauvignon blanc aged in Casa Noble añejo tequila barrels, increased 19% to 93,000 cases in 2019.

Rising Star Drumheller from Ste. Michelle Wine Estates grew 36.2% in 2019 to reach 64,000 cases. The line includes a Columbia Valley cabernet sauvignon and chardonnay, each priced at $12 per 750-ml. bottle, and launched nationally as an on-premise-only brand in March 2016.

While drier wines have been driving sales, Fast Track brand Roscato is bucking industry trends right now, says Hal Cashman, a director of brand development for Palm Bay International, which imports the wines from Northern Italy. “With the sweet wine category down on volume over the past 52 weeks, Roscato is growing at 6.5% in the retail channel,” Cashman says.

In addition to the sweet red wine, Roscato includes a smooth red blend and a dark red blend. Roscato has always had a strong on-premise presence as well, Cashman says. “On-premise account led promotions via sampling, inclusion in cocktails and affordable by-the-glass prices are key.” Tastings are important for the brand, he adds.

Alternative Packaging

The growth rate of the 750-milliliter wine bottle format has slipped in the past year, according to The State of the Wine Industry Report 2020, as expected with the fall of total wine volume. But both the 375-ml. and 500-ml. bottle formats are growing, as is the 3-liter category, which is capturing premium bag-in-a-box.

Indeed, Rising Star Barefoot on Tap, packaging in colorful 3-liter boxes, went from 100,000 cases in 2018 to 600,000 in 2019. The E & J Gallo brand extension includes chardonnay, pinot noir, moscato, cabernet sauvignon, pinot grigio and rosé.

Delicato Family Wines’ Botabox continues to climb. The boxed wine brand was up 15.3% over 2018, and reached 7.95 million cases last year. It’s not only a Fast Track winner in 2020, but Botabox is also one of the year’s highest-selling and fastest-growing brands among our winners.

Wines packaged in cans have also taken off in the past year. The can format still accounts for less than 0.5% of wine sold in the U.S., Velez notes. “But as more higher quality wines in cans have been introduced, it has begun resonating with consumers—particularly Millennials—due to the quality, affordability, portability/convenience, individual servings for portion control and environmental sustainability.”

Rising Star Crafters Union reached 106,000 cases in 2019—a huge leap from the 7,000 cases sold in 2018. The premium line of canned wines from Constellation Brands includes a pinot grigio, rosé and a red blend. Fellow Rising Star brand Ava Grace Vineyards from The Wine Group packages its rosé and pinot grigio in a 375-ml. cans. The brand—which also includes a chardonnay, sauvignon blanc, red blend and merlot sold in 750-ml. bottles—was up 25% in 2019 to 225,000 cases.

Butter Chardonnay by JaM Cellars JaM Cellars has been offered in cans since 2018. The Fast Track brand, which saw a 12% increase in 2019, is also available in magnum (1.5-liter) bottles in big box stores and select retailers across the U.S.

Marketing Magic

Generic wines, which have no story or attachment to a place, have fallen out of favor with consumers during the past 50 years, according to The State of the Wine Industry Report 2020. Many Growth Brands winners have taken steps to connect with their customers and promote their wine’s history and provenance in unique ways.

For instance, Beringer Brothers wines, which launched in 2018, feature labels with a historic photo of the founders in front of the winery, and graphics that evoke the original labels.

They also have the Living Wines Labels augmented reality app, which when activated “comes to life” with messages from brothers Jacob and Frederick Beringer, who founded a Napa winery/ distillery 150 years ago.

Fast Track brand 19 Crimes, which grew 17% last year, has featured augmented reality on its label for a few years.

Social media has been an effective marketing channel for Roscato, Cashman says. The consumer demographics of the channel line up well with the Roscato consumer. “We’ll also continue to advertise online” to grow the brand, he says.

Barefoot on Tap was scheduled to partner with actress Mindy Kaling in May on a campaign celebrating JOMO—the “Joy of Missing Out.” The JOMO concept invites consumers to embrace a night in with a glass of Barefoot, even if that means getting creative with an excuse to cancel plans.

The Vanderpump brand will launch several line extensions to add to its rosé, including a cabernet sauvignon and chardonnay from California’s Sonoma region, as well as both a red and pink Sangria.

“Our marketing strategy will be supported by an increase in our social media activity, as well as investing in advertising in traditional print media and leading trade publications,” Willcock says.

Yealands in early 2020 introduced a fresh new look to the brand that reflects the winery’s picturesque oceanfront location in Marlborough’s Awatere Valley, as well as communicating unique features of the vineyards, Willcock says.

“The new packaging and marketing campaign—inspired by the coast that borders Yealands’ Seaview Vineyard—will drive consumer engagement at retail and bring our customers that little bit closer to our beautiful home.”

Melissa Dowling is editor of Cheers magazine, our on-premise sister publication. Read her recent story, Travel Report: Living The Languedoc.

Melissa- Curious why Josh Cellars was omitted from any of your lists of top brand. As the largest premium wine brand ($10+ 750ML pricing) in the world and the single largest contributor to wine industry dollar growth in IRI and Nielsen for the last 4 years in a row, this seems like an odd omission. Do you not have our reported data?

[…] Melissa Dowling is editor of Cheers magazine, our on-premise sister publication. Read her recent story, America’s Fastest-Growing Wine Brands. […]

[…] comes as alternative packaging continues to gain popularity in the wine […]

[…] del Poggio, a 2020 Beverage Dynamics Established Growth Brand, announces a packaging update, as the Zonin-owned property in Piedmont prepares to hit the […]

[…] del Poggio, a 2020 Beverage Dynamics Established Growth Brand, announces a packaging update, as the Zonin-owned property in Piedmont prepares to hit the […]