The pandemic has changed how people buy alcohol with the rise of alcohol ecommerce.

When the health crisis first hit in early 2020 — sweeping suddenly over America like a bad dream — alcohol businesses had to adapt their operations almost overnight. As a result, ecommerce exploded.

“I can’t tell you how many times I’ve heard major suppliers tell me that they compressed a three-to-five year digital commerce plan into the last 12 months,” says Buddy Buckner, associate counsel for NABCA, speaking during the organization’s 2021 Legal Symposium last month. Ecommerce was a dominant topic throughout the event.

As the pandemic wore on, the unfortunate closures of bars and restaurants significantly pushed consumer spending towards alcohol retail stores. As business boomed for this segment of the industry, companies that provided retail ecommerce services likewise flourished.

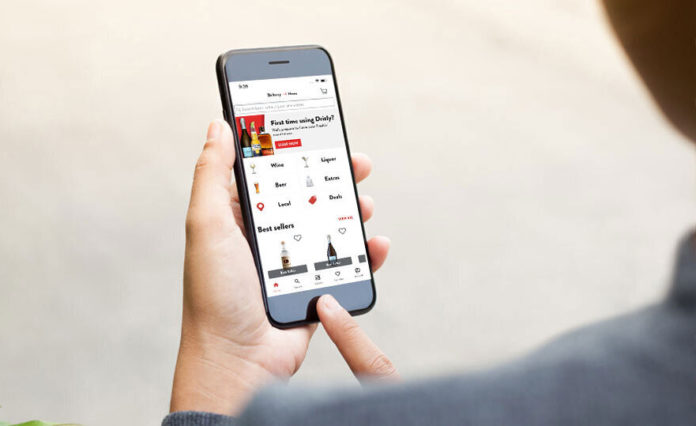

Ecommerce platform City Hive grew 1,000%, year-over-year, in 2020, says Bourcard Nesin, researcher for Rabobank, during the NABCA symposium. Digital delivery provider Drizly grew 300%.

Nearly any alcohol business plugged into ecommerce benefited from the past year. But as vaccines roll out, and more people leave their stay-at-home lifestyles for a reopened economy, the question remains: How will U.S. consumers purchase alcohol after the pandemic ends?

The Future of Alcohol Ecommerce

Another way to ask this question is: How many consumer habits formed during the pandemic will remain afterwards? Will people return to brick-and-mortar shopping? Or has Covid-19 permanently altered buying behavior?

At Drizly, they see a whole new world.

“We believe that this past year has been an inflection point for the category,” says Liz Pacquette, director of brand, and head of consumer insights. “Alcohol ecommerce was already a growing category. Prior to the pandemic, our main growth obstacle was a lack of consumer awareness — 45% of people didn’t know alcohol delivery was legal. This past year, things certainly shifted and accelerated that level of awareness. We expect the growth to continue even after the pandemic subsides.”

In other words, the genie is out of the bottle — and unlikely to get back in.

Agreeing with her is David Nichols, president of Spirits Network. Launched in 2019, this is a shoppable over-the-top platform, with its own collection of programming and livestreaming content. It’s Netflix meets The Food Network meets Amazon. Consumers click in for content like whiskey documentaries and cocktail classes, and can easily obtain featured products by buying onscreen.

“More people are comfortable than ever with buying alcohol online,” says Nichols. “The cat’s out of the bag. It’s no longer just the early adapters doing it — it’s more mainstream now.”

Spirits Network membership has increased 500% since the pandemic, he adds, with 35% of members purchasing through the platform. Since 2019, the average cart size has doubled from $100 to $200.

Like other alcohol ecommerce companies, Spirits Network outsources the actual sale and delivery of products to local retailers. After a viewer inputs an order, the network’s backend finds the closest store that carries that product.

Beyond affiliate fees, this lets retailers acquire customers for little cost, Nichols says. “It’s mostly found opportunities for them.”

As for consumers, shopping alcohol on the Spirits Network is as simple as watching TV in your living room.

“We don’t have anything interrupting the content,” Nichols explains. “For commercials, an ad pops up in the corner than you can click on. The product is added to your cart and you can complete the transaction while watching the programming. It’s the non-interrupted entertainment that people crave.”

This kind of consumer behavior stems from the immediate pleasures of social media — plus the broader growth of ecommerce, led by Amazon and next-day deliveries.

“There’s enormous demand now for instant gratification,” says Richard Blau, shareholder for the law firm GrayRobinson, speaking during NABCA Legal 2021. “We need to have it and we need to have it now. The ability to buy instantly leads to the desire to receive instantly.”

This also ties into the rise of ecommerce websites for beverage alcohol retailers. Whether created by Drizly, City Hive, another company, or the retailers themselves, these sites let customers browse available products digitally. The shelves and aisles have moved online. It’s no different than shopping on Amazon.

“Consumers expect these kinds of services across categories — beverage alcohol will be no exception,” says Pacquette of Drizly. “According to Consumer Reports, 71% of current Drizly users and 50% of non-Drizly users anticipate at least 50% of their alcohol shopping will take place online, vs. in store, in the next year. Under 5% of alcohol transactions are done online currently, but we expect that to continue to grow in the coming years.”

In another sign of the alcohol ecommerce boom, FedEx has begun experimenting with same-day alcohol deliveries, on an interstate basis.

“Last time, this year, we offered it for the first time in California,” says Dustin Pickens, senior council, FedEx. “Then we saw opportunity as the pandemic happened, and now we offer the service is 10 states. That’s a pretty meteoric increase: nine states in eight months.”

Data is King

With the surge of alcohol ecommerce comes a parallel movement: the continued collection of consumer data.

When news broke of Uber buying Drizly back in February, many people recognized the natural affinity: Uber Eats plus alcohol delivery. But it’s more than that. Both companies excel through strategic use of consumer data.

“Data can help brands and retailers to accomplish the old marketing adage in an extremely effective manner — reaching the right person, at the right time, in the right place, with the right message,” says Pacquette of Drizly. “That goes all the way from the product itself — for example: identifying opportunities to innovate in or expand inventory in categories that are experiencing exponential growth — through to the marketing itself. Are you developing creative that aligns with how consumers are actually using your product or products you sell?”

Every purchase helps build a consumer profile. Every item tells a story of someone’s consumption preferences and immediate need.

In a past interview about the Uber/Drizly deal, Dale Renner, founder and CEO of Redpoint Global, a specialist in customer engagement and data management, explains, “They want to know your house, who lives there, what are your preferences, buying patterns, price points. Drizly obviously also does this. Look left to right on their website, and you’ll have a hard time finding anything over $35. They can tell whom they’re selling to. Those ads reflect back to the consumer base.”

Obviously, consumer data collection in the alcohol industry extends far beyond Drizly. Savvy retailers create customer profiles through purchasing statistics. At Spirits Network, they keep keeps track of what beverage alcohol shows viewers watch, and like Netflix, leverage that invaluable data for future content suggestions.

“Based on your interests, we push forward shows about what you like,” says Nichols. “On the back end we have different tags and algorithms to get content towards you.”

The rapidly emerging trend of alcohol ecommerce taps into our increasingly digital lifestyles. It’s a natural transition — buying alcohol online — as more things move onto our cell phones and laptops. By any estimate, alcohol ecommerce will continue to grow exponentially in the future. But no revolution comes without dangers.

Risks in Alcohol Ecommerce

Perhaps the biggest hazard in alcohol ecommerce is the issue of underage buyers. Infants today play with plastic toys meant to mimic cell phones. Little children operate computers better than their parents. What’s stopping a kid from ordering alcohol?

Like other delivery services, FedEx has trained employees to check IDs, Pickens says. The driver delivering these products knows how to determine whether an ID is valid, whether the recipient is actually 21 or older, and whether the recipient is sober.

Drizly has partnered with the American Beverage Institute to provide educational tools for retail employees tasked with deliveries. During a recent Drizly webinar, One Year Post Lockdown, Zannis Mamounas, principal manager of Georgio’s Liquors, says he trains delivery staff to ID customers “if they look under 40.”

Another issue is what role — technically, legally — do alcohol ecommerce companies play in the three-tier system? Unlike most other alcohol-related companies, Drizly and its competitors do not hold state-issued licenses. Which begs the question, as stated by Blau during NABCA Legal 2021: “Do these companies warrant some form of oversight to ensure that the alcohol laws of your state are being kept?”

Would that kind of oversight technically turn these companies into the fourth tier of the alcohol industry? Otherwise, as many argued during the NABCA event, we will see continued blurring of the tiers as ecommerce escalates.

Blau also brought up another grey area worth considering. Countless social media influencers have expanded into the world of alcohol. Cocktail classes, whiskey reviews, sponsored posts and similar content is now common online.

“Influencers sell their influence, and when alcohol companies buy that influence, there is the issue of responsible disclosure,” Blau says. “What’s the responsibility to post responsibly? There doesn’t seem to be any formal rules that compel this. It’s an issue that warrants sober consideration.”

What’s Next?

As technology tends not to backtrack, we can expect the influence of data and digital to increase considerably in the alcohol industry.

“Think about digital sensors monitoring your wine cellar, or what’s in your fridge,” says Renner of Redpoint Global. “Digital connections will automatically manage your wine cellar, your booze cabinet and your refrigerator, because barcodes can be scanned. We’ll subscribe for deliveries, and place orders for special deliveries. This is the future for the entire industry.”

Drizly predicts a similar outcome.

“More brands are building out their ecommerce teams and capabilities, more retailers are seeing this as a critical diversification strategy, more consumers are turning to these kinds of services,” says Pacquette. “The outlook for sustained growth of e-commerce within the $120 billion total annual alcohol category is strong. We predict that online sales potentially could comprise 20% of all adult beverage purchases within the next five years.”

Kyle Swartz is editor of Beverage Dynamics magazine. Reach him at kswartz@epgmediallc.com or on Twitter @kswartzz. Read his recent piece Why Whiskey Nerds Are Getting Nerdier.