While the overall beer category remains relatively flat, nonalcoholic beer has emerged as a new growth center. These brews grew 38% in 2019, according to Nielsen data, and around 39% in 2020.

Why? A number of factors play into the recent success of nonalcoholic beer. Foremost is the rise of the healthier lifestyle. This trend had permeated through the alcohol industry long before Covid-19 pushed health to the forefront of everyone’s thoughts. Younger drinkers, in particular, are counting calories, researching product ingredients and looking for lower-ABV options.

The modern “healthier drinking” movement appeared first in spirits with mocktails and nonalcoholic options like Seedlip. Wine and beer quickly followed suit. Nonalcoholic beer has always existed, of course, largely as lagers for people who cannot consume traditional brews for health reasons. But the new wave of nonalc alternatives has improved dramatically upon their predecessors in terms of flavor and variety.

Simply put: Nonalcoholic beer now tastes like beer.

It wasn’t always the case. Even in recent time, as brewers first released products for the healthier lifestyle, many of these options struggled to leave consumers thinking, “This is beer.” Instead, the beverages were often watery, and far from the flavors they tried to replicate.

Nonalcohlic Beer Blossoms with Craft

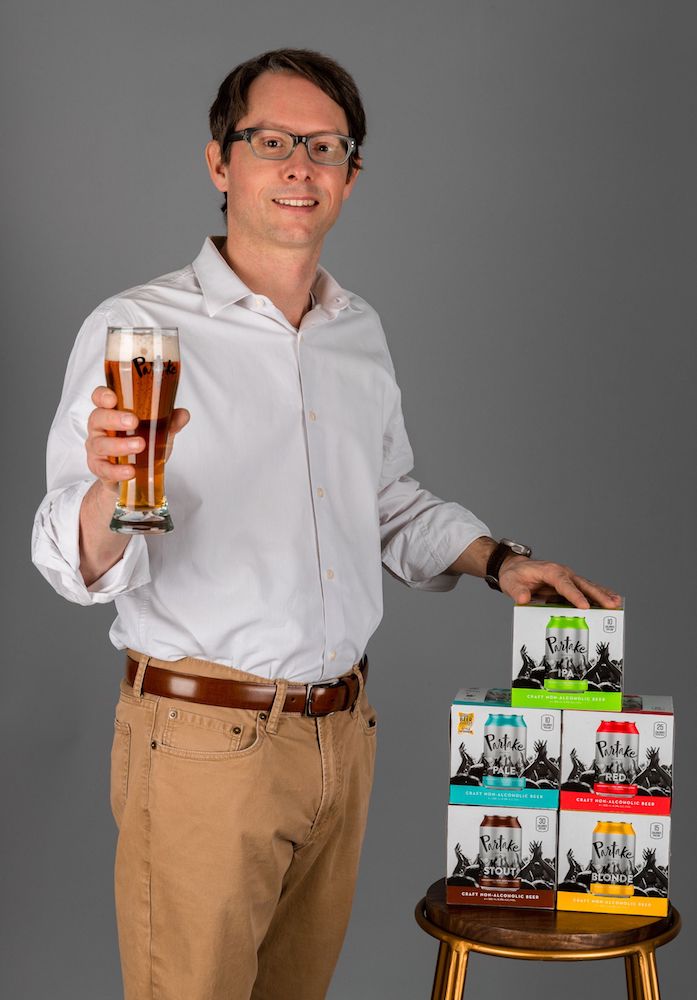

Much has changed in the last few years. Beer flavors in the category have improved by leaps and bounds, led by innovators like Athletic Brewing and Partake Brewing. The latter offers consumers an array of nonalcoholic beer that spans the craft spectrum: IPA, DIPA, Pale Ale, Blonde, Stout, Red (AKA: an amber ale) and more. The IPAs have hop, the dark beers taste of dark malts, and the blonde and red exhibit the right amount of malt-forward flavor.

“When we started, we began with two constraints,” says Partake Founder and CEO Ted Fleming. “We had to get our beers below that 0.5% ABV threshold to be considered nonalcoholic, and we wanted to get correct taste profiles outside of lagers, as before all of this, most nonalcoholic beers were lagers.”

Fleming knew first hand how bad most nonalcoholic beers tasted before this new wave. Due to health reasons he had to give up his love of craft beer about a decade ago. Disappointed with the lack of flavorful options, he founded Partake in 2017.

Working with the science department at a local college he focused on, “making the best nonalcoholic beer we could, recreating craft beer flavors in a nonalcoholic format.”

This required extensive experimentation. Trials spanned years, across numerous techniques and ingredients. The result is a brand with a rapidly expanding footprint in the U.S., through distribution partners such as Southern Glazers Wine & Spirits and Breakthru Beverage Group.

“We dug into the category and helped make it a lot better,” says Fleming. “The varieties you see now in nonalcoholic beer are reminiscent of where the craft beer category was 10 to 15 years ago. There’s more innovation and imagination in this category right now than there has ever been before.”

“Other people seeing companies like Partake that are dedicated to nonalcoholic, it’s helping lift up the entire category,” he adds. “Before, nonalcoholic beer was just small brands within Big Beer companies. Big Beer didn’t care as much about the category. It took dedicated, smaller companies to change that.”

Big Nonalcoholic Beer

Many global drinks corporations have recently launched large nonalcoholic brands in the U.S. Heineken was among the first with Heineken 0.0, which has become a top seller. That Heineken was among the first Big Beer companies behind this trend in America speaks to an important point: nonalcoholic beer is already well established overseas, where it has a healthy share of the overall beer market (more on that below).

So it made sense when the Japanese distiller and brewer Suntory announced late last year that it was bringing the sparkling nonalcoholic beer, All-Free, into the U.S. market.

Launched in Japan 13 years ago, All-Free is made using the same two-row barley malt as normal beers, contributing similar flavor. Aroma hops provide the typical bitterness on the nose. This recipe enables the removal of the fermentation process for a 0.0% ABV beer.

Take out fermentation, however, and beer becomes flat. Alcoholic beer carbonates while fermenting within the bottle. This happens as yeast metabolizes sugar within a bottle of alcoholic beer, creating more alcohol, with the byproduct of carbon dioxide — hence, carbonation.

So how are nonalcoholic beers carbonated? One way is through de-alcoholization. This takes fully brewed (and fermented) alcoholic beer, and removes the alcohol. Doing so requires heat and membrane-based processes like vacuum distillation, membrane filtration and reverse osmosis. It’s an expensive process that requires a great deal of modern equipment.

However, if a brewery decides that it does want to skip fermentation (like with All-Free), the other method for carbonation is by injecting carbon dioxide into the bottle or can. Soda producers use a similar method with carbonated soda.

Either way, these advanced techniques show how far the likes of Suntory and All-Free have come in the production of high-quality nonalcohlolic beer.

“Companies likes Suntory are making greater investment in new product development, and this has led to a rise in the product quality of NA beverages,” says Yuichi Kato, All-Free head of product development. “Thus, the taste of non-alcoholic beers has been improved greatly by the efforts of makers to meet consumer needs.”

Suntory worked on the American version of All-Free since 2015. Company brewers visited the U.S., sampling hundreds of craft and non-alcoholic beers. As a result, All-Free has a slightly different formula in the American market. For instance, it does not contain additional flavoring components.

“It is very challenging to realize beer-like taste without fermentation process because the fermentation process plays a key role in creating beer flavor and aroma,” says Kato. “The usage of artificial flavor or artificial sweetener would decrease the difficulty of accomplishing authentic beer flavor, as it would allow the creation of certain types of flavor nuances that would help us mimic beer flavor. However, we decided not to use artificial flavor or artificial sweetener as we discovered that U.S. consumers are sensitive to flavor and aroma. Additionally, they tend to be more cautious about ingredients used in food and beverages.”

Further legitimizing the U.S. nonalcoholic beer space are recent entries from craft beer pioneers Sam Adams and Dogfish Head.

“I think non-alc beer is not catching up to full-strength beer, whereby consumers are looking for more flavor and more diverse choices,” says Dogfish Head Founder and President Sam Calagione. “It’s an extension of the craft brewing renaissance, and our Lemon Quest delivers on both real, craft beer flavor and a pioneering recipe that incorporates both active lifestyle-oriented culinary ingredients and super refreshing attributes.”

Dogfish Head’s Lemon Quest is made with real lemon puree, blueberry juice, acai berries, monk fruit, sea salt and Hopsteiner Polyphenol-Rich Hop Pellets. The production process includes both de-alcoholization and low-gravity fermentation techniques.

The Future of Nonalcoholic Beer

As the nonalcoholic category grows rapidly, consumer demographics have evolved as well.

“There’s now an element of inclusivity in the category,” says Fleming of Partake. “Five years ago, you felt like a pariah when asking for a nonalcoholic beer. You would get served something with dust on it. Today, you can go into a place and have a nonalcoholic beer that’s unique, flavorful and healthy, while being carefree and proud of it.”

This shift in attitude towards low- and no-ABV is because “people are reexamining their relationship with alcohol,” Fleming continues. “Socializing now isn’t what it was 20 years ago, where it was all about having alcohol to fit in. Now people are choosing to do it more on their own terms.”

Still, the nonalcoholic category remains less than 1% of total beer sales. In Europe, where these brews are more prevalent and popular, that number is closer to 5-10% (depending on the country). Fleming believes that level of penetration is possible in America.

“For us to reach European levels, we’d need to see nonalcoholic beers served in more bars and restaurants,” he says. “For the category to reach more than 5%, nonalcoholic beers would have to become somewhat ubiquitous on-premise and at major event venues.”

Top bars and restaurants in American have already begun transitioning towards healthier drinks.

“More folks than you may think are leaning towards low proof and nonalcoholic drinks these days,” says Julia Momose, co-owner of Kumiko in Chicago. “Some are making a permanent change, while others are enjoying the zero-proof options in between cocktails. I have always carried nonalcoholic beer at my bars, and there has always been a demand for it. Over the course of the pandemic I have seen many friends posting about their afternoon treat of a non-alcoholic beer, and it has been fun to see the many new varieties that are coming out.”

Momose has long been an outspoken proponent for nonalcoholic options. She believes that even more consumers will venture into the category if these drinks switch up their terminology.

“I wrote back in 2017 calling for bars and restaurants to take a look at the nonalcoholic options within their beverage programs and to reconsider the names attributed to these drinks,” she recalls. “‘Mocktail’ has such a negative tone to it, and I suggest the term ‘spiritfree’ as a replacement. The inspiration for this term came from All-Free. I came across the product while visiting my parents back in Japan as I was perusing the extensive non-alcoholic section of the grocery store. I was struck by the positive connotations of the name, and it has inspired many drinks since then.”

Altogether, this paints a rosy picture for the years ahead, as nonalcoholic beers improve in production, quality and an expanding demo.

“It’s hard to predict exactly what the future of the category will look like, but I firmly believe that the non-alc sector will continue to grow double digits annually in the coming years,” says Calagione. “It’s the Millennial and Gen Z drinkers that are driving the growth of low- and no-alcohol beverages. As more and more Gen Z-ers reach legal drinking age, I think the NA category is going to skyrocket.”

Kyle Swartz is editor of Beverage Dynamics magazine. Reach him at kswartz@epgmediallc.com or on Twitter @kswartzz. Read his piece 10 Craft Beer Trends in 2021.

Non-alcohol Beer is a very niche market and brands will come and go. First generation non-alcoholic beers included Moussy, Sharp’s, O’ Doul’s, and Clausthaler’s-few if any are still in the market. It’s just not a sustainable segment of the beer industry.

James Shannon/Metro Communications