The Growth Brands Awards are Beverage Dynamics magazine’s annual program that determines and celebrates the fastest-growing and top-selling spirits, wines and beers in the U.S. These beverage alcohol brands fuel modern trends while maintaining consumer loyalty.

Which products pulled off these tough tasks in the past year? 2023 was an odd year, marked by the continued transition away from the pandemic and its inflationary hangover. While people felt the pinch at grocery stores and the pumps, consumers remained interested in premium alcohol products. And with Covid-19 lockdowns thankfully a thing of the past, bars and restaurants have rebounded, once again helping shape alcohol culture and the rise of certain brands.

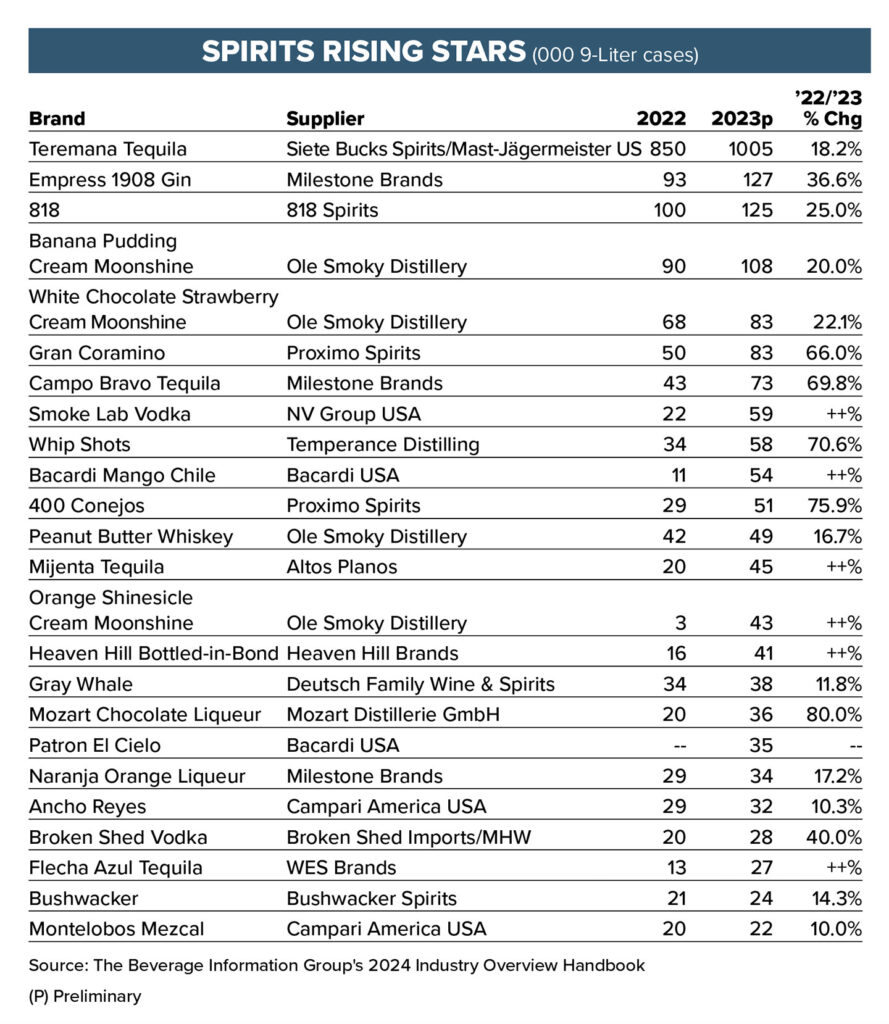

Social media continues to be critical for success, as does flavor innovation. Whiskey and tequila enjoyed another year of growth in 2023, albeit at numbers more “solid” than “explosive.” Ready-to-drink (RTD) beverages are still on the rise, shoving out hard seltzer as the hottest category. Newer trends have emerged. Celebrity alcohol brands and endorsements have catapulted products into the mainstream conscience. Authenticity, sustainability, and social values have never been more important to consumers, especially younger generations, in what they drink.

Premiumization is Key

By now nearly everyone has heard the saying about how today’s consumers drink: less but better. This phrase is a synonym for premiumization. Drinking occasions may be down, but when they do occur, they involve better products. Alcohol remains an affordable luxury, a treat even for younger generations who imbibe less.

Growth Brands winners have noticed.

“In the past year, we’ve seen increasing consumer demand for high-proof bourbon,” says Elizabeth McCall, master distiller of Woodford Reserve, which collected a pair of Fast Track awards in 2024. “To meet this demand, we increased the number of cases we produce of our Batch Proof series, which is released annually as part of our Master’s Collection. Batch Proof allows consumers to taste Woodford Reserve exactly as it comes out of the barrels, and we expect to see continued demand for this product in the future.”

“We also saw an increase in sales of our Double Oaked Bourbon,” she adds.

Like Woodford Reserve, many brands have met this demand for premium products through new innovations.

“Our biggest release this past year is Jefferson’s Tropics: Aged in Humidity,” says Craig Johnson, head of the American Whiskey Collective at Pernod Ricard, speaking for the Fast Track brand Jefferson’s Bourbon.

“Buoyed by the success of Ocean, Jefferson’s wanted to look to new aging environments for its next groundbreaking innovation. The new expression focuses on exposing barrels to extreme weather conditions in Singapore to accelerate maturation and accentuate flavor, with the equatorial heat and humidity allowing the bourbon to deeply interact with the wood, drawing richer flavors like vanilla and caramel.”

Premiumization and innovation are hardly contained to whiskey. Truly a transcendent trend, the allure and staying power of top-shelf products inspires both loyalty and trial in consumers.

“Empress is still a young, developing brand that has nearly tripled its national distribution over the past two years,” says Eric Dopkins, CEO and founder of Milestone Brands, whose collection of Growth Brands winners includes the Rising Star Empress 1908 Gin. “Many consumers experience the brand for the first time as it hits the shelf and restaurant/bar cocktail menus. The ‘indigo’ blue gin makes the most distinctive cocktails that colors truly change with the mixer’s PH levels, leaving consumers with a beautiful botanical gin cocktail experience.”

Premiumization also comes in the form of local, better ingredients.

“Our master blender had a goal to make vodka that showcased the natural resources of New Zealand. We think he succeeded,” says Jean-Marie Heins, CMO for the Rising Star winner, Broken Shed. “Broken Shed Vodka is made without any additives, using only the whey distillate and our special blend of two waters, one from each main island of New Zealand. The minerals in the South Island water give our vodka a lovely roundness and a great mouthfeel. The whey distills cleanly, allowing the nuances of the distillate to shine through in the final product. Once people try our vodka, they see why we say taste to see what it means to be different.”

Premiumization has also played a role in helping rum rebound.

“Appleton Estate has a strong portfolio of super premium aged rums, and they were the predominant drivers of growth for the brand in 2023 — particularly the 8 Year Old, 12 Year Old and 21 Year Old rums,” says Andrea Sengara, vice president of marketing, Campari America, of the Comeback Award winner. “Additionally, the brand has seen a healthy appetite for limited, high-end offerings. Appleton Estate 17 Year Old Legend — an exclusive and faithful recreation of the legendary rum that was crafted by J. Wray & Nephew on the Estate in the 1940s and is known worldwide as the storied inspiration for the creation of the original Mai Tai cocktail — was released in June 2023 and sold out in minutes through the brand’s digital channels.”

The Celebrity Spotlight

Perhaps the biggest trend in the past year has been the rapid rise of celebrity alcohol brands. While endorsements and investments from the rich and the famous have always been part of the industry, these have reached new heights in recent time. Suddenly, everyone on TMZ also has a tequila to their name.

All it takes is celebrity buy-in.

“Mark Wahlberg, a principal investor in the brand, drew mass attention to Flecha Azul at every stop of the ‘Enjoyed Everywhere’ promotional tour, driving more earned media than we could have imagined,” says Lauren Ryan-Kiyak, senior vice president, marketing for WES Brands, which is behind the Rising Star winner. “The tour was so effective that Flecha sold out in multiple markets.”

Like burgers, like tequila. The same reason that folks flock to Wahlburgers is why they began buying Flecha Azul when they recognized the famous faced behind the brand. Celebrities come with their own built-in audiences. Tapping into that to fuel growth for an alcohol product can rocket a brand several years ahead of where its sales would have been otherwise.

Accordingly, it’s increasingly common now for the founders of a brand-new alcohol brand to search for a celebrity they might attach to the product. Finetuning flavor and packaging is critical, and perhaps so is getting the celebrity right.

Other times you’ll see an existing product find the right match years after launching. For instance, perennial Growth Brand Spirits winner BuzzBallz.

“We partnered with and fostered a continued relationship with Blake Anderson of the Workaholics TV show and This Is Important podcast after witnessing his organic love of the brand, and created an ad campaign as well as unofficially sponsoring many stops of his This Is Important podcast tour, bringing in a new core audience to our fanbase,” says Brady Bouldin, brand marketing associate for BuzzBallz/Southern Champion.

“Our partnership with Blake Anderson created a lot of buzz (pun intended) considering he was our first official large celebrity partnership for the brand,” Bouldin added. “We partnered with video production agency Bacon & Eggs to create humorous and captivating ads with Blake that we were able to run throughout the summer along with our other influencer marketing campaigns.”

Celebrity endorsements come in different forms across different industries and pastimes.

“In celebration of Valentine’s Day, Whipshots joined forces with renowned sex therapist Dr. Ruth for an innovative social campaign that brought forth a blend of expertise and fun,” says David Dreyer, CMO of Starco Brands, which produces the Rising Star winner. “Dr. Ruth offered tips on how to indulge in sexual wellbeing with the help of Whipshots, creating a sense of playfulness and pleasure that captured the essence of the holiday.”

“Whipshots’ Cardi B and legendary singer Patti LaBelle teamed up for a holiday campaign that merged the boozy fun of Whipshots with the decadence of Patti’s Good Life products,” Dreyer adds. “This collaboration paired Whipshots flavors alongside select items from Patti’s Good Life and served as the launch of Whipshots Pumpkin Spice flavor.”

Celebrity endorsements can also crossover with significant cultural events.

“Through a first-of-its-kind creative integration during the 96th Academy Awards, Tequila Don Julio debuted its ‘1942 minis’ for the ultimate star-studded introduction,” says Karen Harris, vice president of Tequila Don Julio, Diageo North America, for the Fast Track brand. “Host Jimmy Kimmel and Guillermo Rodriguez treated audience attendees to the never-before-seen Tequila Don Julio 1942 minis in the first-ever spirits integration during a live Oscars telecast.”

The Right Values

Consumers are increasingly attracted to brands that share their values, or at least have values that are commendable. People don’t just want to enjoy what they drink nowadays — they want to feel good about it, too.

“Our ocean conservation mission and brand partnership with [nonprofit ocean conservation organization] Oceana drives deep brand affinity, helping remind consumers that Gray Whale is a gin for good,” says Sarah Gorvitz, vice president of communications for Deutsch Family Wine & Spirits, which owns the Rising Star.

“We created legislative change, permanently protecting the oceans off the West Coast. Through our partnership with Oceana — their logo is on the back of our bottle — we engaged in an important conservation issue: the negative impact of drift gillnets on marine life,” Gorvitz adds. “For years, commercial fisheries relied on 2-mile long, 200-yard deep nets to catch swordfish. However, they also harm more than sixty other marine species, including gray whales. Through our efforts, these nets are now banned in every state, including California.”

Broken Shed Vodka is another brand with a charitable focus.

“A main focus for us is giving back to the community and our main vehicle for this in the United States is our partnership with Help Our Military Heroes,” says Heins. “We plan to run the program again this year where we will donate $1 for every bottle of Broken Shed Vodka we sell to an account in October.”

The organization takes every dollar Broken Shed donates and uses it for their mission to provide adaptive vehicles to veterans in need. “We have contributed $139,000 towards this mission over the past few years of running the program.”

Social Media Shines

Brands always have to meet customers where they are, and these days that’s on social media. Creating content for these channels has never been more important, and will remain so for the foreseeable future. Especially as the target demographics become younger and younger generations.

In 2024, “We reorganized our organic social media to be more attuned to popular trends in pop and Gen Z culture,” says Bouldin of BuzzBallz. “Thanks to viral content on social media platforms like TikTok, our BuzzBallz Biggies were hard to find on shelves for the whole year. We have created new production lines to produce more Biggies and keep up with that high demand.”

Brands remain committed to “The Empress 1908 Gin brand has the highest socials and digital engagement in the gin category,” says Dopkins. “It also helps when Taylor Swift fans made cocktails on social media when her ‘Lavender Haze’ single was released at midnight, social content with Empress 1908 Gin went viral, adding to the brands distinctivity!”

Content is king on social media and digital in general. Savvy brands look for unique ways to capture consumer attention online.

“Aperol recently introduced ‘Life View,’ a new platform on the Aperol website that allows viewers from around the world to experience a 360-degree interactive journey through authentic Venetian life,” says Campari America’s Sengara, of the Fast Track winner.

“Hosted on Google Maps Street View, Aperol’s ‘Life View’ allows viewers to immerse in Italian culture and explore the lesser-known scenes and waterways of Venice through the eyes of locals, including glass-blowing artists, gondoliers, fresh produce deliveries and more. Shot on an Insta360 Pro 2 camera in 8K 3D VR, the content captures every detail in every direction.”

Social media also leads into digital sales.

“Ecommerce has also been an important channel for the Campari Group,” Sengara says, “as we look to further integrate strategic programs into our marketing platforms across the portfolio. [Fast Track winner] Espolòn remained the number-one premium tequila sold online in 2023.”

“And, with IWSR forecasting total online beverage alcohol sales to grow 4.3% in 2024,” Sengara adds, “we will remain agile in this channel and continue to look for unique and exciting ways to reach our consumers online.”

Liquid to Lips

For the constant talk of digital this and social that, nobody will deny that the old saying, “Liquid to lips,” remains extremely relevant. Particularly in our post-pandemic world, as people joyously return to fairs and festivals, seeking the on-premise experiences that they missed for years.

“On the trade and shopper side of things, we ramped up our events presence and were on site nearly every weekend of the year at one or more events around the country meeting new people and bringing the BuzzBallz brand to festivals, tastings and other social gatherings,” says Bouldin.

Echoing Bouldin is Jenny Manger, Marussia Beverages U.S. portfolio director, which is behind the Rising Brand winner Mozart Chocolate Liqueur.

“Getting liquid to lips was a big driver for the Mozart Chocolate Collection,” she says, “between in-store tasting events, brunches, happy hours and consumer events. It was key for us to showcase the versatility of Mozart — as a neat pour, on the rocks, in a Martini, in coffee and in cocktails. Communicating directly with the consumer and letting them know that we have a chocolate liqueur for everyone.”

In terms of attracting consumers to seek out and taste your brand, as another old saying goes, “if you build it, they will come.” As such, “We’re very excited about the upcoming opening of the new Jefferson’s distillery and visitor experience, which will be a 115,000 barrel-a-year facility that will be one of the most sustainable distilleries ever built,” says Johnson. “The distillery is nestled on approximately 250 acres in beautiful Marion County, a place that has a rich bourbon distilling history.”

Accordingly, many companies have build sizeable visitor centers, or “brand homes,” that attract tourism while exposing new people to the products.

“Ole Smoky continues to stay at the forefront of the spirits industry and hold their consistent title as the most visited distillery in the world,” says Will Ensign, vice president of marketing for Ole Smoky Distillery, which took home an array of Spirits Growth Brands awards.

“In addition to their focus on product innovation and quality, Ole Smoky credits a significant portion of their success to the vibrant atmosphere, hospitable employees and exciting events and promotions at their four distillery locations.”

Flavors Appeal

A large part behind the success of a winning brand like Ole Smoky is their impressive collection of flavors that connect with consumers.

“In 2023, Ole Smoky introduced innovative, unique and quality products showcased in its four distilleries like Tennessee Straight Bourbon Whiskey, Pink Lemonade Moonshine, Chocolate Peanut Butter Cream Moonshine and Moonshine Mandarins, as well as a national release of the Banana Whiskey and Orange Shinesicle Cream Moonshine,” says Ensign.

BuzzBallz captured sales last year through similar, flavor-driven strategies.

“Our top SKUs this year were our wine-based Choco Chiller and spirits-based Tequila ‘Rita,” says Bouldin. “This has been consistent for the past few years, in part because of our increased distribution and sales in the chain space. We created anticipation this year with limited holiday runs of pumpkin, eggnog, and cookie flavors that incentivized our consumers to go out and get their hands on the exclusive holiday options.”

It’s a similar sentiment across the industry: flavors pique consumer interest, which generates sales.

“Our hero Mozart Chocolate Cream drove the majority of sales, but all three of our core SKUs — Chocolate Cream, White Chocolate Cream and Dark Chocolate — saw triple-digit growth in depletions,” says Manger of Marussia Beverages. “We’re excited to launch Mozart Coconut Cream Liqueur this summer. We will be launching it at Tales of the Cocktail this year.”

The vodka-infused whip cream brand Whipshots also captured sales through new and popular flavors.

“Whipshots core flavors — Vanilla, Caramel and Mocha — consistently drive strong sales, maintaining their appeal with returning customers,” says Dreyer. “However, Whipshots’ release of new limited-edition Lime, Pumpkin Spice, and Peppermint flavors were able to capitalize on seasonal trends and provide consistent news for the brand.” The range of new flavors in the portfolio offered a diverse array of options, “which allowed buyers to purchase a can based on their preferences and specific occasions throughout the year,” he says.

“By tapping into the appeal of seasonal flavors, Whipshots attracted both new and returning customers, driving sales through their limited-edition offerings,” Dreyer adds.

Many brands see new flavors as an innovative way to expand product lines.

“Ancho Reyes recently released Ancho Reyes Barrica, a refined expression of the beloved Ancho Reyes original liqueur, with the introduction of ex-bourbon barrel aging for added richness, depth and complexity,” says Sengara of Campari America, of the Rising Star winner.

“This release marks the first-ever barrel-aged chile liqueur, and the first new offering from the Ancho Reyes portfolio since the successful release of Ancho Reyes Verde in 2017.”

Looking Ahead

While many folks are quick to point out how U.S. spirits sales have slowed here in recent time, it’s important that we remember this is not the case globally. Much the opposite, actually.

“The U.S. is still the largest market for Woodford Reserve, but our sales are growing rapidly globally,” says McCall. “Woodford Reserve had a successful past year — still growing as brand even though total distilled spirits slowed overall. We are also continuing to increase our distribution points both in the United States and globally.”

Even if overseas sales do not qualify for Growth Brands Awards, they serve as an important source of revenue for many products. With sales slowing somewhat in America, spirits products can still flourish thanks to extra revenue generated by global purchases. Though if the White House changes hands to a president more inclined towards tariffs, that’s a potentially different story.

Otherwise, look for more of the same in 2024. Premiumization should lead, followed by the trendiest innovations. Especially if the U.S. economy continues to perform better than analysts had predicted.

The post-Covid recession that so many had predicted, fueled by inflation, has so far not reared its ugly, ruinous head. Instead, inflation has cooled to moderate levels while consumers, though cautious, remain willing to spend.

Kyle Swartz is editor of Beverage Dynamics. Reach him at kswartz@epgmediallc.com. Read his recent pieces, What’s New at Your Favorite Kentucky Bourbon Distilleries? and How Long Can Tequila’s Growth Last?